McManus: A tax everyone can love

The chairmen of Congress’ primary tax committees, Sen. Max Baucus (D-Mont.) and Rep. Dave Camp (R-Mich.), have launched a bipartisan effort to reform our messy, inefficient federal tax law. They’ve agreed to look for ways to lower tax rates on both individuals and corporations and at the same time “close loopholes.”

But Baucus and Camp are going to run into a big problem: One taxpayer’s “loophole” is another’s sacred birthright. The only deductions in the personal income tax code big enough to make a significant difference in revenue are the ones for home mortgage interest, charitable contributions and state and local taxes. And every previous attempt to trim or limit them has run into a buzz saw of opposition.

So here’s another good bipartisan idea that the tax committees should consider: a new federal tax on emissions — more frequently called a carbon tax.

SLIDE SHOW: 10 reasons to salute L.A.’s transportation future

We already know that we use more energy from oil, gas and coal than we really need. (America consumes the equivalent of about 48 barrels of oil per person per year; Germany, with the healthiest economy in Europe, consumes just 26.) We know that lower consumption would make us less dependent on other countries for energy, a goal every president since Richard Nixon has pursued. We know that oil and coal produce air pollution, which we’d like to reduce. And we know that those fuels emit carbon dioxide, which contributes to global warming.

Economists call the hidden costs of energy consumption — the prices of climate change, pollution and national security — “externalities.” They’re real costs, but they’re not included in the price of the gasoline you put in your car or the electricity you use at home.

Even the federal gasoline tax that’s now levied doesn’t come anywhere near covering its purpose of paying for highways. The gas tax has been stuck at about 18 cents a gallon since 1993; if it had risen with inflation over those 20 years, it would be about 30 cents.

A federal carbon tax, though, would apply to more than just gasoline. It would be levied on any fuel that produces carbon dioxide emissions. That means it would fall heavily on coal, less heavily on oil and only lightly on natural gas. It would make energy efficiency more valuable and alternative energy (like wind power) more competitive.

The downside, of course, is that it would raise prices. A recent carbon tax proposal from the Brookings Institution, for example, would raise the price of gasoline by 16 cents a gallon in the first year, and would increase with inflation after that.

That’s where tax reform fits in. Any increase in the price of gasoline will feel like a raw deal to every car owner — especially low-income car owners. But if a carbon tax is part of a larger tax reform effort, most or all of the money that’s collected can be returned to consumers — in the form of lower tax rates, tax rebates or other measures to ease the pain.

Who could possibly like a big new federal tax like this one? Republican economists, that’s who.

An astonishingly long list of conservative economists have endorsed this idea — mostly because they’re convinced that global warming is a real problem and they’d rather address it through the efficient mechanism of prices than the inefficient (often Democratic) answer of regulation. (Being Republicans, they also want the carbon tax to be “revenue neutral” — that is, they don’t want it to increase the federal government’s net tax receipts or encourage more federal spending.)

GOP supporters of a carbon tax include Glenn Hubbard, who was Mitt Romney’s chief economic advisor last year; Douglas Holtz-Eakin, who advised 2008 presidential candidate John McCain; N. Gregory Mankiw, chairman of the White House Council of Economic Advisers under President George W. Bush; and George P. Shultz, secretary of State under President Reagan.

So who’s against it? Republican politicians, led by House Speaker John A. Boehner (R-Ohio). Boehner thinks a carbon tax “would raise energy and gas prices and cost American jobs,” his spokesman, Michael Steel, told me last week.

Other conservatives worry that Congress won’t keep any promise to cut other taxes in exchange for raising an energy tax. And any new tax — especially one that raises gas prices — will be a hard sell to many voters.

Sen. Michael B. Enzi (R-Wyo.) proposed a modest increase in the gas tax last year to fund highway construction but got little support from either party; now that he’s preparing to run for reelection in 2014, he’s dropped the idea.

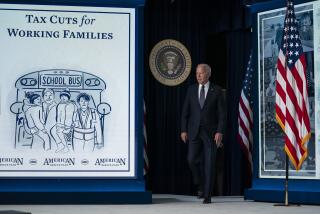

Even President Obama, who has said he wants to do more about global warming in his second term, has steered carefully around this remedy. “We would never propose a carbon tax,” Obama spokesman Jay Carney said last year.

Until 2011, there was at least one conservative champion of a carbon tax in the House, Rep. Bob Inglis (R-S.C.). But Inglis was defeated in the 2010 GOP primary by a tea party candidate who criticized him for believing in global warming. “I really am the worst commercial for this idea,” said Inglis, who now runs a think tank promoting the carbon tax. “There are lots of Republicans [in Congress] who know better … but they’re not going to come out of their foxholes until they think it’s safe.”

Does that mean the carbon tax is an idea whose time has not yet come? No; it’s merely an idea most of us haven’t heard enough about to make us comfortable.

There’s a lot to like about a carbon tax. It would promote efficiency, reduce air pollution, slow climate change and increase energy independence.

If it were part of a “revenue neutral” deal, in which all the taxes that came in were returned to the taxpayers some other way, it wouldn’t cost a nickel. If it were part of a revenue-raising deal, in which some of the taxes didn’t come back, it could help cut the federal deficit and reduce the national debt.

So let’s consider this a test of the American political system: How long can Congress resist an idea this good?

Follow Doyle McManus on Twitter @DoyleMcManus

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.