Taxing marijuana won’t do nearly as much for homeless people as a sales tax increase

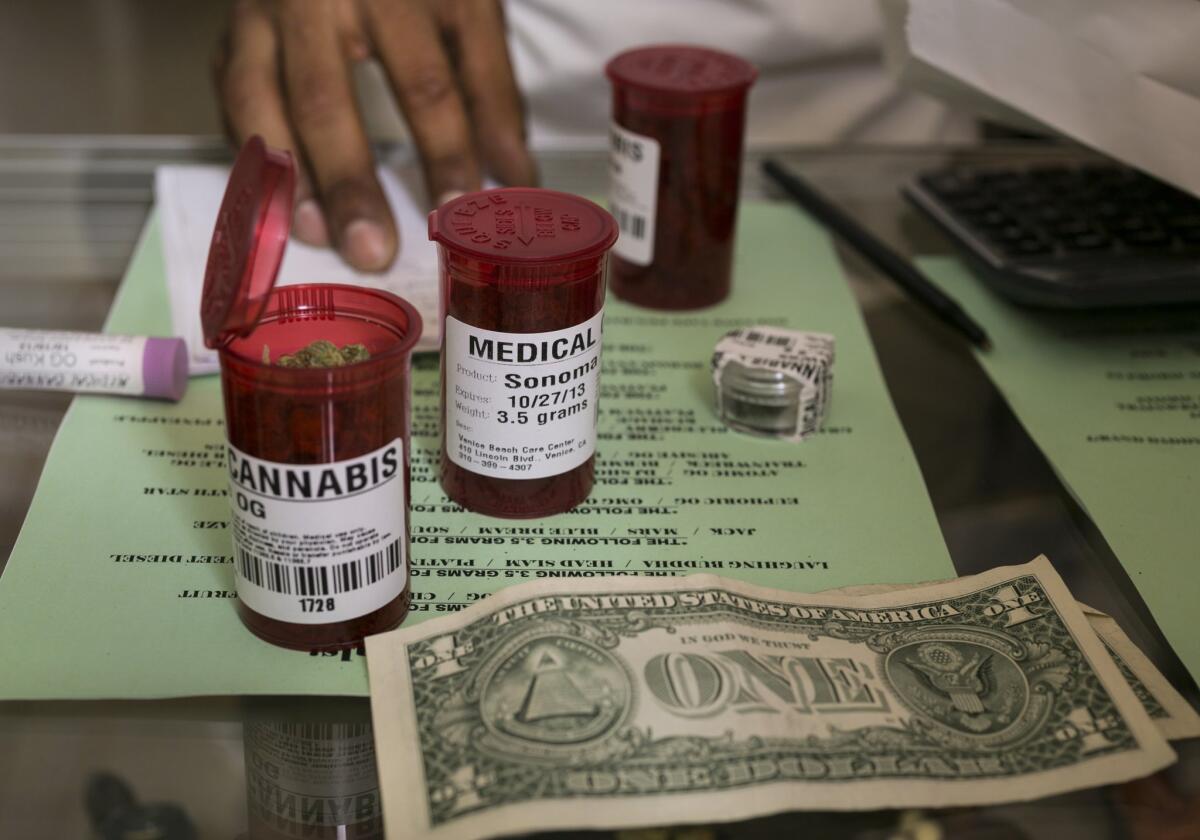

To the editor: The biggest problem with the Los Angeles County Board of Supervisor’s ballot initiative to tax marijuana businesses to help pay for homeless services is that this very small amount of funding would only be available in two years if the voters pass Proposition 64 in November and legalize recreational pot use. (“County marijuana tax for homeless services to appear on November’s ballot,” July 12)

Using history as a guide, an increase of 12% in the homeless population over two years would translate to more than 5,000 additional homeless people in that time. Given that about 30% of people experiencing homelessness are former foster youth, such a significant increase would be unconscionable.

The governor proposes to build more housing for mentally ill homeless people, but with planning and permitting, it could be another five years before a single unit becomes available. A quarter-cent sales tax increase is the only funding mechanism that would give us relief from increasing homelessness when we need it: now.

Marsha Temple, Los Angeles

The writer is executive director of the nonprofit Integrated Recovery Network.

..

To the editor: Before any taxes are collected from pot dispensaries, banking services must be made available to marijuana businesses. L.A. County Treasurer-Tax Collector Joseph Kelly’s suggestion to hire armored trucks to collect millions of dollars in cash is rife with opportunity for unaccountability, corruption and extortion.

Also, a portion of marijuana sales tax revenue should be used to fund additional personnel at the Department of Public Health to test product samples for potency and pesticides or other chemicals; for the county’s Weights and Measures Bureau to check scales for accuracy; and for dispensary personnel to be trained and certified, equivalent to a bartender license.

Janis Purins, Los Angeles

..

To the editor: Since the county wants a 10% tax on “medical” and recreational marijuana and related products, then why aren’t all prescription and over-the-counter medications also being included?

A 10% tax on the gross receipts of the big pharmaceutical companies and retailers would produce a hell of a lot more revenue than just taxing companies that produce and distribute marijuana and “related” products.

Jim Skladany, San Bernardino

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.