Editorial: No more stock trading for members of Congress

As a frightening new virus began spreading around the world in early 2020, a few lawmakers made some very well-timed stock trades.

Republican Sen. Richard M. Burr of North Carolina sold shares in hotel companies that would lose value as travel dropped amid the rising pandemic. Then-Sen. Kelly Loeffler, a Georgia Republican, and her husband bought stock in a company that makes teleworking software, which gained value as millions of people began working from home weeks later. The wife of GOP Sen. Rand Paul of Kentucky bought stock in Gilead Sciences, which went on to develop an antiviral drug used to treat COVID-19.

All of this was before the coronavirus upended normal life in the U.S., sickened millions of people and caused wild changes in stock prices. But it was after senators were privately briefed in late January on the emerging threat the new virus posed to the nation.

The Justice Department closed its insider trading investigations of Loeffler and Burr without filing charges, as well as of California Democratic Sen. Dianne Feinstein, whose husband sold stock unrelated to the pandemic; she said she did not attend the private briefing. But the prospect that public officials might have personally benefited from their access to sensitive information about COVID-19 triggered a wave of ethical concerns still rippling through the country. A poll last month found that 63% of voters — including majorities of both Democrats and Republicans — say members of Congress should be banned from trading stock.

Dozens of lawmakers have come out in support of competing but similar bills that would limit their ability to hold or trade stocks while in office.

We agree. It is important that elected officials behave ethically but also that people perceive that ethics are foundational in our government. Restricting the ability of lawmakers to trade stock can build trust that they are working in the public interest and have no financial motive when they vote on legislation affecting companies and industries.

Bipartisan proposals to limit lawmakers from trading stock have been introduced in the House and Senate. The bills take slightly different approaches — one would require lawmakers to sell their stock before they take office; another would allow stocks to be placed in a blind trust. They also vary on whether lawmakers’ spouses would be allowed to own individual stocks. None would bar lawmakers from investing in mutual funds.

This ought to be a political slam dunk at a time when populist energy is surging on both the left and the right. Besides, most members of Congress don’t report trading any stock, and their image is tarnished by those who do. At least 113 lawmakers disclosed stock transactions made by themselves or family members in 2021, according to a MarketWatch report — trades worth an estimated $355 million. What really stinks: Many of these lawmakers are buying and selling stock in companies that routinely lobby Congress. Their decisions on how to regulate tech, healthcare and energy companies could play a role in how much the stock is worth.

Rep. Ro Khanna (D-Fremont) reported that his family members made an estimated $52.7 million in stock trades in 2021, including buying shares in Microsoft, Apple and Facebook parent company Meta. The assets belong to his wife and are not held in a joint account, Khanna’s spokesperson told MarketWatch.

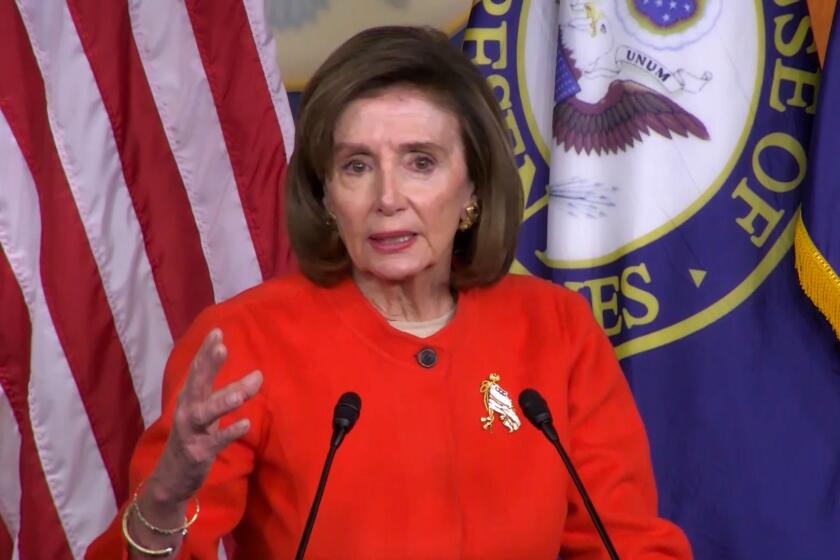

Similarly, House Speaker Nancy Pelosi (D-San Francisco) does not personally own stock, but her husband is a frequent trader. He bought an estimated $12 million worth of stock in 2021, according to MarketWatch. Those included shares in Google parent company Alphabet, as well as in software giant Salesforce and video game platform Roblox. Pelosi’s husband is such a successful trader that someone developed a blog to help retail investors learn from his moves. There is no evidence that he has inside information, but that’s clearly the perception.

Khanna and Pelosi are not typical — they’re among the lawmakers who report the most stock trading. More common are smaller transactions, like Rep. Adam B. Schiff (D-Burbank) selling an estimated $25,000 in stock in the AbbVie biopharmaceutical company in two transactions last year, or Rep. Mike Garcia (R-Santa Clarita) buying an estimated $65,000 in Tesla stock last April and selling it in October. (It’s not clear if he made a profit or took a loss because the amounts are reported in ranges.)

Pelosi initially rebuffed the idea of limiting stock trading by members of Congress, saying they should be able to participate in the free market. More recently she said she’s open to restrictions and assigned a committee to review the proposals.

Perception is reality in politics, the adage goes. Lawmakers must get behind a robust plan to limit their colleagues’ stock trading so that the perception — and the reality — is that they’re doing the people’s business.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.