California voters just approved more taxes, but the new state budget could still be lean on cash

Reporting from Sacramento — In the six years since Gov. Jerry Brown returned to the state Capitol, his relatively parsimonious approach to state budgets has been consistent enough to leave few watchers expecting major surprises.

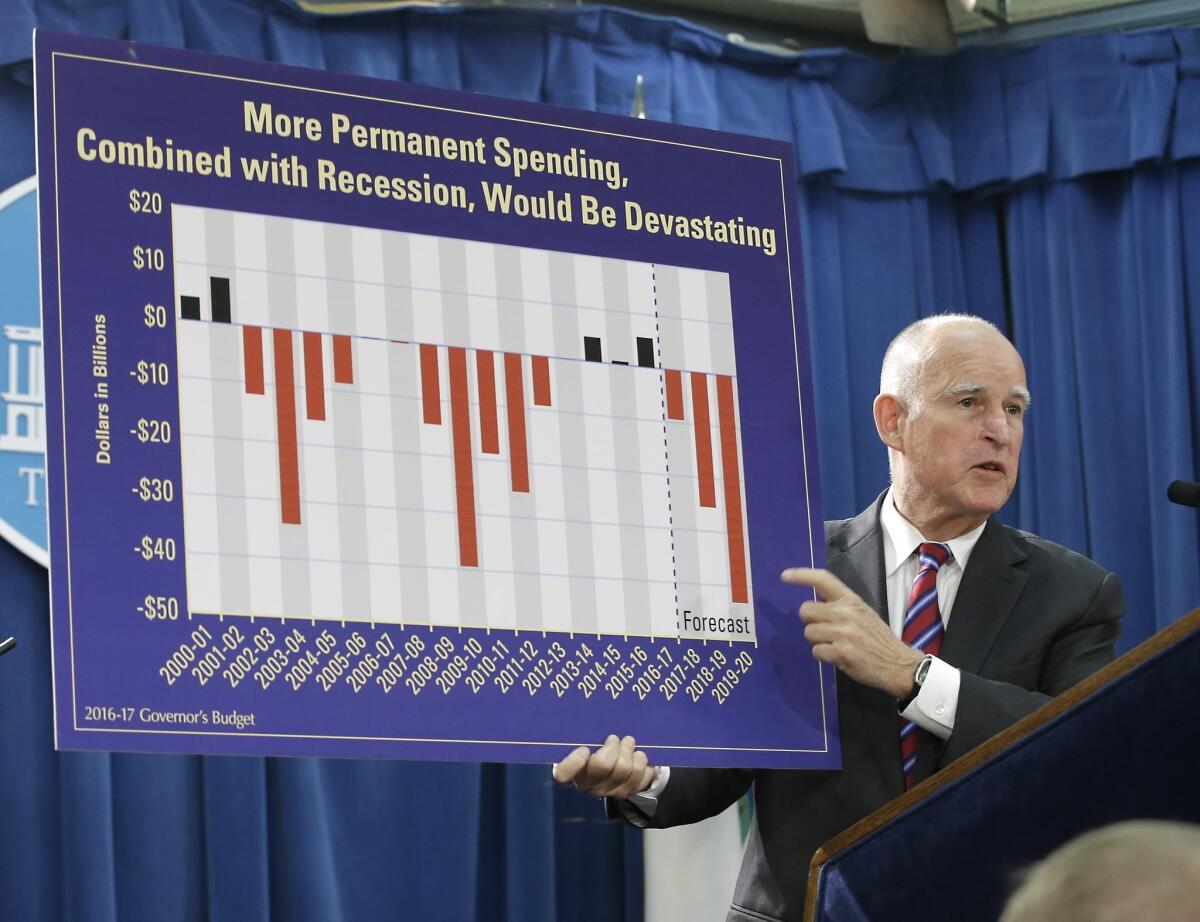

But recent events in California and the nation suggest the fiscal proposal Brown unveils next week could be his most circumspect to date, even after voters in November approved billions of dollars in additional taxes.

For the record:

12:09 p.m. Nov. 28, 2024The source of the quotation in the final paragraph of this article was misidentified as Sen. Holly Mitchell. The remark was made by Gov. Jerry Brown’s budget spokesman, H.D. Palmer.

“We have a number of significant fiscal pressures that are looming,” said H.D. Palmer, the governor’s budget spokesman.

Although the details of the new budget plan remain under wraps, the underlying economic data are hidden in plain sight.

On Thursday, the independent Legislative Analyst’s Office reported that preliminary tax collections in December — a key month for quarterly tax payments — were almost $1.2 billion below predictions. The state Department of Finance, which doesn’t release its December analysis until next week, has reported several months of anemic tax collections in comparison to the assumptions built in to the foundation of the California budget that Brown signed into law in June.

Remember when California’s state budget was always late? Here’s what changed »

The absence of hundreds of millions of dollars in expected tax revenues — whether Brown will go so far as to call it an actual deficit remains to be seen — could only sharpen the annual haggling between the governor and legislative leaders over revenue projections, a negotiation that has routinely left Brown with the upper hand.

Few will be surprised if Brown uses the lackluster revenue data to demand scaled back growth in future spending or cuts in current spending on some programs.

“Having watched this governor over the last several years, I think that’s a reasonable expectation,” said Sen. Holly Mitchell (D-Los Angeles), the new chairwoman of the state Senate’s budget committee.

Voters, though, may find news of missing state tax revenues a surprise after ratifying two major tax measures on the Nov. 8 ballot. Proposition 55 will extend current tax rates on the most wealthy that otherwise would have expired in 2018. Proposition 56 raised the state’s tobacco tax by an additional $2 per pack of cigarettes.

The political campaign in support of Proposition 55 promised it would prevent cuts to public school funding, which generally is protected by state constitutional funding requirements. Still, sagging revenues could shrink the expected rate of growth in school spending. That could leave education advocates deflated over their efforts to further restore programs that were cut during the recession.

Proposition 56 offers an intriguing test for 2016’s campaign rhetoric in light of current conditions. Although the measure specifically promises new tobacco tax revenues as a way to “increase funding” for healthcare services under the state’s Medi-Cal system, the program’s existing dollars could now be at risk. The net effect could be a smaller boost than the ballot measure’s proponents had hoped for.

In fact, Medi-Cal’s reliance on federal dollars may be the most worrisome part of the budget year ahead, given its dramatic expansion with dollars provided by the Affordable Care Act. President-elect Donald Trump’s promise to repeal Obamacare could affect the more than 3.8 million Californians who have enrolled in Medi-Cal.

In all, the program’s expansion is budgeted to cost $16.1 billion in the current budget year. All but $819 million of that money comes from the federal government, an enormous risk for the state in the years to come.

“It depends on how quickly the federal government acts,” Mitchell said.

The early indication is that GOP congressional leaders are still wrestling with how to repeal and replace President Obama’s signature law, and state budget watchers expect Brown’s proposal next week to remain largely silent on the looming shift. Still, few feel calm about what lies ahead.

“There’s so much uncertainty,” said Chris Hoene, executive director of the California Budget and Policy Center, which advocates for programs aimed at helping the working poor.

Hoene usually urges lawmakers to do much more when it comes to funding social services programs, but concedes caution may be in order with the arrival of the Trump administration.

“That just seems like smart budget making at this point,” he said.

In fact, the uncertainty of which way the national political winds will blow could slow the pace of early state budget negotiations even more than usual. The unveiling of a governor’s January budget proposal offers an important first glimpse, but the actual work on crafting a spending plan generally doesn’t begin until April tax revenues are counted.

This time, state budget watchers say, important decisions may need to wait until much later.

“Taken together,” Mitchell said, “all of these pressures make a powerful case for a prudent budget.”

Follow @johnmyers on Twitter, sign up for our daily Essential Politics newsletter and listen to the weekly California Politics Podcast

ALSO

Brown and lawmakers agree to a budget that provides money for housing and child care

California will rely even more on the wealthy under Prop 55’s tax plan

Updates on California politics and government

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.