Free money: Amid the coronavirus, a monthly paycheck from the feds doesn’t seem crazy

The notion of the federal government handing out free money used to be a liberal dream and a conservative nightmare. No more.

The coronavirus outbreak, which plunged the nation into an economic free fall, has created an opening for governments and nonprofits to experiment with giving money directly to Americans, with no strings attached.

In Los Angeles, thousands have been handed “Angeleno cards” — no-fee debit cards loaded with $700 to $1,500. Across the nation, food stamp recipients are getting a $1,000 check from a private effort whose leaders include former presidential candidate Andrew Yang.

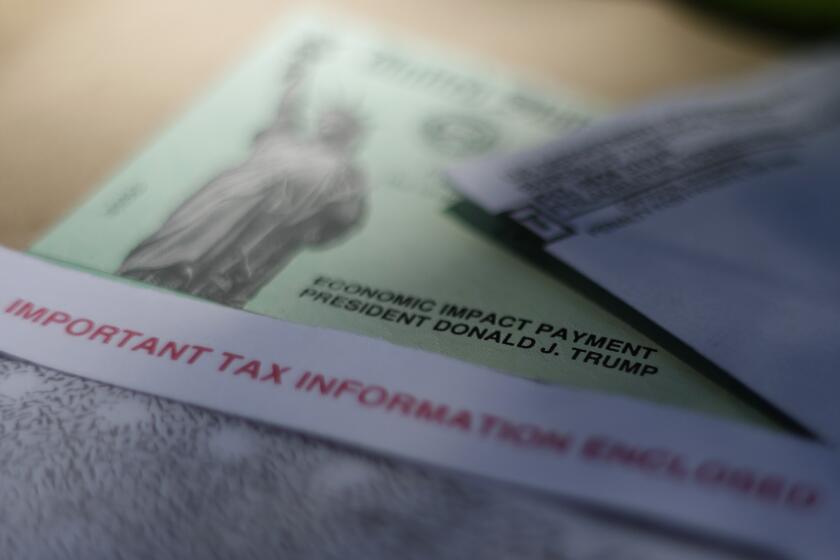

The federal government, with near-unanimous support from Democrats and Republicans, is sending up to $1,200 to most people to blunt unprecedented job losses. Democrats in the Senate and the House have proposed even larger monthly payments.

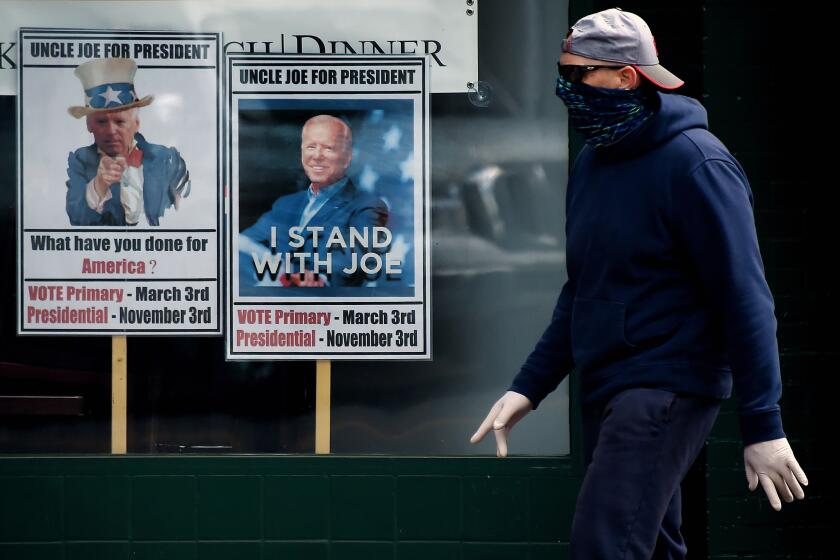

During the 2020 presidential campaign, Yang proposed a universal basic income, with the U.S. providing $1,000 every month to every American adult. It seemed an unlikely proposal, but now leading Democrats have warmed to the idea.

House Speaker Nancy Pelosi (D-San Francisco) said last month on MSNBC that a “guaranteed income” may be “worthy of attention now.”

Yang described the recent cash infusions as a common-sense solution when the nation’s economy is experiencing “10 years’ worth of change in 10 weeks.” These payments, he said, are laying the groundwork for broader, more ambitious programs.

“Millions of Americans have already got that $1,200 stimulus check in their bank account and they felt this sense of relief and security,” he said. “We’re going to remember this feeling, and I think universal basic income is going to become a huge part of the solutions we implement not just to get through this crisis but also to help rebuild our economy and country as we start to emerge.”

The bipartisan support for the coronavirus stimulus checks shows how quickly attitudes have evolved. Not so long ago, government assistance was viewed by many as benefits that discouraged recipients from seeking work.

“The poor have been denigrated for a long time. [Take] the image of the welfare queen,” said Michael Faye, co-founder of GiveDirectly, which has provided more than $160 million to the poor around the world since 2009.

The COVID-19 pandemic is making people realize their shared vulnerabilities, he said, because of the widespread impact.

“No one said if you got COVID and lost your job, it’s because you’re naive or uneducated,” Faye said. “Everyone is affected and everyone knows someone that was affected economically. When that happens, we ask ourselves, how should we help my neighbor who lost his job and how would I like to be helped myself?”

Joe Biden’s pledges to ‘change the system’ echo Bernie Sanders and Elizabeth Warren and reflect a new American reality.

GiveDirectly partnered with Yang, former Georgia gubernatorial candidate Stacey Abrams and others to launch an effort to give $1,000 each to 100,000 families receiving food stamps. The group has raised $82 million of its $100-million goal.

In Los Angeles, Mayor Eric Garcetti helped put together a privately funded $20-million program to provide 20,000 individuals and families with Angeleno cards. Those living in the city qualified if their household income is below the federal poverty line and they have experienced a job loss or income reduction because of the crisis.

None of the programs fully qualify as a true universal basic income, or UBI, which provides cash payments regularly and unconditionally to all individuals without a means test. However, these recent programs do share some similarities — notably giving money directly to people and allowing them to decide how to spend it.

The concept of a universal basic income has been floated in the United States since the country’s founding, supported by leaders as ideologically disparate as President Nixon and the Rev. Martin Luther King Jr. A version was passed by the U.S. House of Representatives in 1970, but failed in the Senate.

“We’re closer than we’ve ever been,” said Stockton Mayor Michael Tubbs, a longtime UBI proponent who is overseeing a trial run in his Central Valley city.

In February 2019, 125 Stockton residents began receiving $500 per month for 18 months. Proponents point to research that shows the recipients used the money for essentials, such as food. Their level of employment was similar to a control group of residents who did not receive the payments.

For Laura Plummer, 69, the payments saved her from being homeless. Her apartment burned down last year, and she and her 8-year-old dog, PooPee, have been couch-surfing since then. She just moved into an $800-per-month loft in Stockton. Without the UBI payments, Plummer said, she wouldn’t have been able to save for the security deposit.

“I’d definitely be in the street sleeping in my car with my dog,” she said.

As the economy continues to slide, there is a proposal for a second coronavirus stimulus, but its passage doesn’t look likely in the near-term.

The longest continuing direct-cash payment program in the United States exists in the Republican-run state of Alaska, where residents have received an annual payment funded by oil revenue since 1982. The Alaska Permanent Fund is viewed in the state as a birthright, not a form of welfare.

In the nation’s capital, Democrats have been the most vocal supporters of such programs.

Reps. Ro Khanna (D-Fremont) and Tim Ryan (D-Ohio) introduced a bill last month that would grant $2,000 per month for six months to Americans 16 and older who make less than $130,000 annually. In the Senate, Kamala Harris of California, Bernie Sanders of Vermont and Edward J. Markey of Massachusetts introduced a bill to provide $2,000 monthly to people who make less than $120,000 annually until 90 days after the pandemic is over.

Utah Sen. Mitt Romney was among the first Republicans to pose a similar idea — a $1,000 immediate cash payment — as the White House and congressional leaders hammered out an economic response to the crisis.

That deal resulted in the CARES Act, which provided the one-time federal stimulus checks to single people who earn up to $99,000 or married couples up to $198,000. The legislation was passed unanimously in the Senate and on a near-unanimous voice vote in the House.

Enacting such payouts permanently faces major obstacles, notably funding. Creating a program that is expected to cost trillions of dollars could necessitate deep cuts in other areas and a reimagining of the nation’s social safety net. Such proposals would also face criticism that they disincentivize work, as critics allege.

It is also uncertain how long bipartisan cooperation will continue once the pandemic — and the accompanying economic pain — abates.

“Everyone’s still in crisis response mode,” said Jesse Rothstein, director of the Institute for Research on Labor and Employment at UC Berkeley. “I don’t know anyone who’s done any long-term rethinking. If you asked five years ago whether they thought there would ever be any circumstance where 20% to 30% of people stop working and have government make up that income, it would have been unimaginable.”

Lawmakers will face pressure to extend these benefits, said Joshua Rauh, a Stanford University graduate school professor who served as principal chief economist on President Trump’s Council of Economic Advisors.

“Once these things get started, it’s very hard to stop them,” he said. “Once you think about it that way … we’re getting closer to something that certainly resembles universal basic income.”

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.