As coronavirus ravaged U.S. economy, Georgia Sen. Perdue saw an opportunity

WASHINGTON — Last March, as the coronavirus crisis forced millions of people out of work, shuttered businesses and shrank the value of retirement accounts, Sen. David Perdue saw something else: a stock-buying opportunity.

For the second time in less than two months, the Georgia Republican’s timing was impeccable. While the market overall was plunging, he reaped a stunning gain by buying shares in a company whose stock he had only recently unloaded: Cardlytics, an Atlanta-based financial tech firm on whose board of directors he once served.

Perdue had sold off $1 million to $5 million in Cardlytics stock, at $86 a share, on Jan. 23 before its value plunged, according to congressional disclosures. Perdue unloaded the shares as word spread through Congress that the new coronavirus posed a major economic and public health threat.

But weeks later, in March, after Cardlytics’ stock fell even more following an unexpected leadership shakeup and lower-than-forecast earnings, Perdue bought the stock back for $30 a share, investing between $200,000 and $500,000.

Those shares have now quadrupled in value, closing at $121 a share on Tuesday — meaning a gain for Perdue in the range of $600,000 to $1.5 million.

Those profitable transactions were just a sample of the large number of investment decisions made in the early days of the pandemic by Perdue and other senators. They stirred public outrage after it became clear that some members of Congress had been briefed on the economic and health threat the coronavirus posed. The transactions were mentioned briefly in a story published by the Intercept in May.

Sen. David Perdue purposefully butchered his colleague Sen. Kamala Harris’ name at a Trump rally, drawing criticism. They’ve served together since 2017.

Now that Perdue is locked in a pitched battle for reelection in a Jan. 5 runoff, his trades during a public health and economic crisis have become an issue in what already has become a negative, expensive campaign that could determine which party controls the Senate.

There is no evidence that Perdue, who is among the wealthier members of the Senate, acted on information gained as a member of Congress or through his long-standing relationship with company executives. It’s illegal to use nonpublic information gained as a company insider or member of Congress to make investment decisions.

But legal experts say the timing of his sale, the fact that he quickly bought back Cardlytics stock when it had lost two-thirds of its market value and his close ties to company executives all warrant scrutiny.

“This does seem suspicious,” said John C. Coffee Jr., a Columbia University law school professor who specializes in corporate and securities issues. But, he added, “you need more than suspicions to convict.”

With Georgia’s GOP feuding since Joe Biden won there, a question looms: Can it unite to help two senators win runoffs that will decide which party runs the Senate?

The Perdue campaign declined a request for an interview. In a statement, Perdue spokesperson John Burke said the senator had been cleared of wrongdoing, but did not provide details.

“The bipartisan Senate Ethics Committee, DOJ and SEC all independently and swiftly cleared Senator Perdue months ago, which was reported on,” Burke said, referring to the Justice Department and the federal Securities and Exchange Commission.

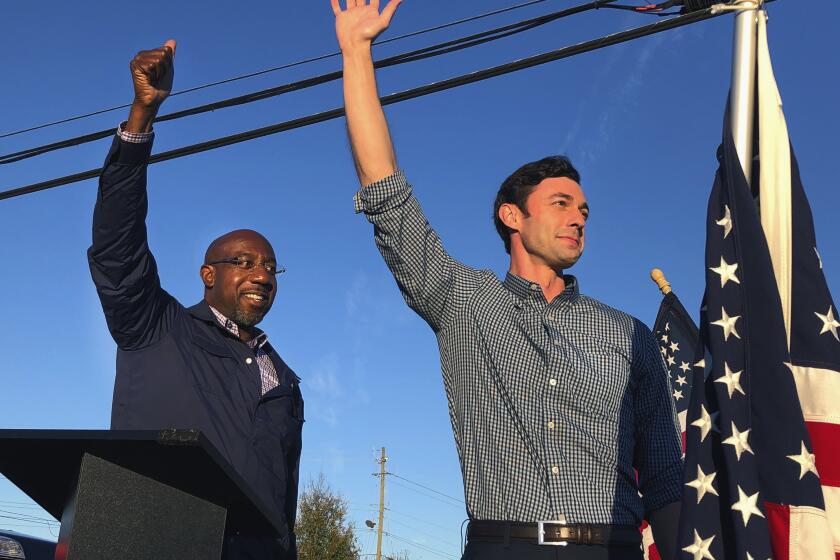

Perdue’s opponent in the runoff, Democrat Jon Ossoff, has seized on Perdue’s stock trading and branded him as a “crook.”

Perdue is not the only senator on the ballot in Georgia. Fellow GOP Sen. Kelly Loeffler is running against Democrat Raphael Warnock in a bid to complete the remainder of retired Sen. Johnny Isakson’s term. If Warnock and Ossoff can both pull off wins, the Democrats would in effect have control of the Senate.

Republican Sen. David Perdue of Georgia has removed a campaign ad that enlarged the nose of his Democratic opponent, Jon Ossoff, who is Jewish.

Perdue’s Cardlytics transactions fit into a broader pattern of stock moves he made when the coronavirus first struck the U.S.

At the time, Perdue publicly maintained that the economy was strong and praised President Trump in a Feb. 24 interview on Fox News Channel for “executing the greatest economic turnaround in U.S. history.”

A series of swift transactions in his portfolio told a different story, however, showing that the senator dumped some stocks in some companies while investing in others — such as protective equipment maker DuPont and pharmaceutical company Pfizer — that were poised to do well during the pandemic.

Perdue has previously said that outside financial advisors make most of his trades.

Both Republican and Democratic camps in Georgia embrace running as teams, framing their campaigns around what they can accomplish — or stop — together.

But Donna Nagy, an Indiana University law professor, said that type of arrangement doesn’t preclude Perdue from directing an advisor to make specific transactions. She said one way for members of Congress to avoid questions about their financial holdings is to put them in a blind trust, which Perdue has not done.

“All of these questions about the motivations behind our members of Congress and their personal securities trading could be alleviated if Congress passed a law that limited investments,” said Nagy, who specializes in securities law. “Ordinary citizens should not have to question members of Congress about their investments.”

The issue was enough of a liability that Perdue abruptly sold off between $3.2 million and $9.4 million of his stock portfolio over a four-day period in mid-April, according to an Associated Press review of mandatory financial disclosures that he has submitted to the Senate. He did not sell his stock in Cardlytics.

Still, Perdue has largely avoided the same degree of scrutiny faced by some of his colleagues.

Georgia has long been a reliably red Southern state. Biden becomes the first Democratic presidential candidate to win it since 1992.

Republican Sen. Richard Burr of North Carolina drew the most attention and stepped down as Senate Intelligence Committee chair amid a probe of his sale of upward of $1.7 million in stock, which came when he was privately warning some well-heeled constituents about the coronavirus while publicly downplaying the threat.

Cardlytics works at the intersection of banking and online marketing. It helps run rewards programs for financial institutions, including Wells Fargo, using data the banks have gathered on their customers to market to them — similar to what Facebook does with targeted ads.

The company did not respond to a request for comment.

After the March turmoil, its share price dramatically rebounded. Lynne Laube, Cardlytics’ current CEO, said the pandemic had a lot to do with it, driving consumer interest in savings programs.

“I hate to say this pandemic is playing in our favor, but it’s playing in our favor,” she said during an earnings call in May.

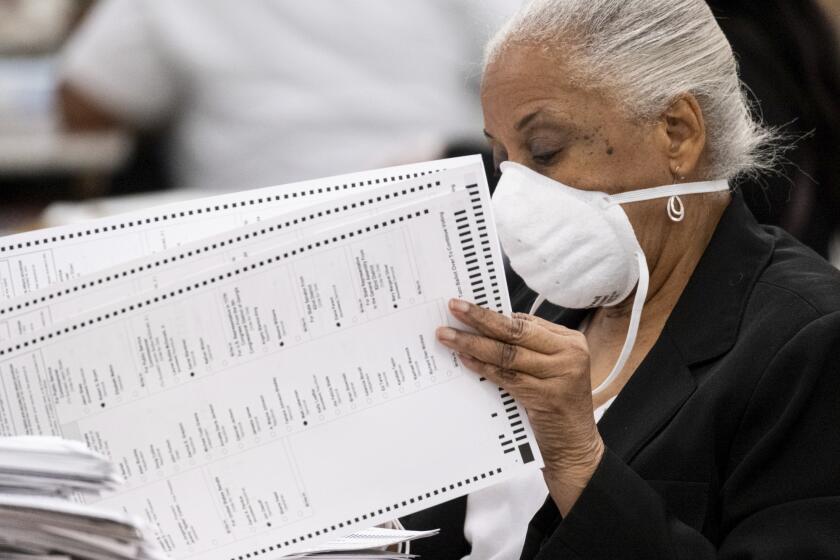

An official machine recount of the 5 million votes cast in Georgia’s presidential race is underway at the request of President Trump’s campaign.

Perdue acquired 75,000 shares in Cardlytics through stock options offered for his service on the company’s board from 2010 to 2014, when he stepped down after winning his Senate seat, SEC filings show. The company, which at the time had not yet gone public, also offered him options on shares that would become available in October 2020 and January 2022.

Perdue’s latest financial disclosures do not indicate whether he has exercised the options that became available in October.

But according to Coffee, the Columbia professor, it’s an unusual move by the company.

“I’ve never seen options extended from 2014 to 2022,” he said. “That’s a very long extension.”

Get our L.A. Times Politics newsletter

The latest news, analysis and insights from our politics team.

You may occasionally receive promotional content from the Los Angeles Times.

While Perdue left the company’s board, he has maintained ties to some of its executives, who have donated more than $30,000 to his political committees. Donations made to Perdue account for nearly 80% of all giving to federal candidates by Cardlytics employees over the past decade, records show.

Perdue, meanwhile, has used social media to publicize the company. In August 2016, he took a tour of its office and posed for a photo with Laube and then-CEO Scott Grimes, which he posted to Facebook. In the fall of 2019, he introduced Laube and Grimes at a gala in Atlanta, where they received a business achievement award.

Isakson, who served with Perdue, took steps to avoid the type of scrutiny Perdue is now facing. Isakson, a Republican, put most of his own holdings in a blind trust after some of his assets drew unwanted attention in 2012.

“I said I need to be as patently pure and patently clean as anybody, and the best way to do that is a blind trust,” Isakson, who served on the Senate’s finance and ethics committees, told the Atlanta Journal-Constitution in 2017. “I don’t know what I own.”

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.