Congress foresees short-term debt limit fix amid perilous standoff

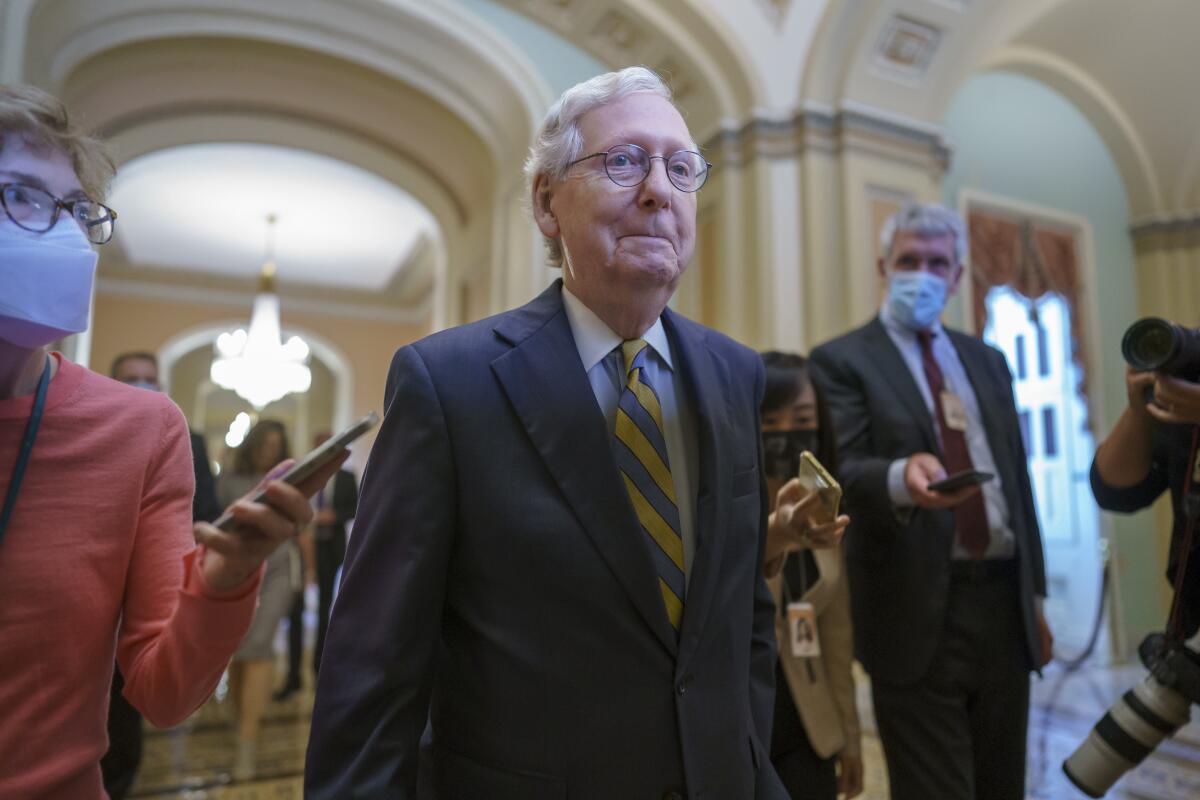

WASHINGTON — Republican and Democratic leaders edged back Wednesday from a perilous standoff over lifting the nation’s borrowing cap, with Democratic senators signaling they were receptive to an offer from Senate GOP leader Mitch McConnell that would allow an emergency extension into December.

McConnell made the offer as Republicans were poised to block legislation to suspend the debt limit until December of next year, and as President Biden and business leaders ramped up their concerns that an unprecedented federal default would disrupt government payments to millions of people and throw the nation into a recession.

Freshman Sen. Kyrsten Sinema campaigned as an independent and is acting that way.

The emerging agreement sets the stage for a sequel in December, when Congress will again face pressing deadlines to fund the government and raise the debt limit before heading home for the holidays.

A procedural vote on the longer extension the Republicans were going to block was abruptly postponed late Wednesday, and the Senate recessed so lawmakers of both parties could discuss their next steps.

Democrats emerged from their meeting more optimistic that a crisis would be averted.

“I’m glad that Mitch McConnell finally saw the light,” said independent Sen. Bernie Sanders of Vermont, who caucuses with Democrats. The Republicans “have finally done the right thing, and at least we now have another couple months in order to get a permanent solution.”

Sen. Christopher S. Murphy (D-Conn.) added that, assuming final details in the emergency legislation are in order, “for the next three months, we’ll continue to make it clear that we are ready to continue to vote to pay our bills, and Republicans aren’t.”

It would be the token of all tokens: a $1-trillion coin that backers say could solve the political impasse over suspending the U.S. debt limit.

McConnell portrayed the situation very differently.

“This will moot Democrats’ excuses about the time crunch they created,” he said, “and give the unified Democratic government more than enough time to pass standalone debt limit legislation through reconciliation.”

Congress is up against an Oct. 18 deadline, when the Treasury Department has warned it will quickly run short of funds to handle the nation’s already accrued debt load.

McConnell and Senate Republicans have said Democrats will have to go it alone to raise the debt ceiling and allow the Treasury to renew its borrowing to meet the government’s financial obligations. McConnell has also said Democrats must use the same cumbersome legislative process — reconciliation — that they used to pass a $1.9-trillion COVID-19 relief bill and that they’re employing in efforts to pass Biden’s $3.5-trillion measure to boost social safety net, health and environmental programs.

In his offer Wednesday, McConnell said Republicans would still insist that Democrats use the reconciliation process for a long-term debt limit extension. However, he said that Republicans were willing to “assist in expediting” that process, and that in the meantime Democrats may use the normal legislative process to pass a short-term debt limit extension.

While he continued to blame Democrats, his offer will allow Republicans to avoid the condemnation they would have gotten from some quarters for causing a financial crisis.

Earlier Wednesday, Biden enlisted top business leaders to push for immediately suspending the debt limit, saying the approaching deadline created the risk of a historic default, like a meteor that could crush the economy and financial markets.

At a White House event, the president shamed Republican senators for threatening to use the filibuster to block any suspension of the $28.4-trillion cap on the government’s borrowing authority. He drove home his message with the help of corporate America — which usually sides with the GOP on tax and regulatory issues — as the heads of Citigroup, JPMorgan Chase and Nasdaq gathered in person and virtually to say the debt limit must be lifted.

“It’s not right, and it’s dangerous,” Biden said of Senate Republicans’ resistance.

The president’s moves came amid talk that Democrats might try to change Senate filibuster rules to get around Republicans. But Sen. Joe Manchin III (D-W.Va.) reiterated his opposition to such a change Wednesday, which probably takes it off the table for Democrats.

The business leaders echoed Biden’s points about needing to end the stalemate as soon as possible, though they sidestepped the partisan tensions. Each portrayed the debt limit as an avoidable crisis.

“We just can’t wait to the last minute to resolve this,” said Jane Fraser, chief executive of the bank Citi. “We are, simply put, playing with fire right now, and our country has suffered so greatly over the last few years. The human and the economic cost of the pandemic has been wrenching, and we don’t need a catastrophe of our own making.”

The financial markets have yet to fully register the drama in Washington, though there are signs that they are getting jittery, said Adena Friedman, CEO of the Nasdaq stock exchange.

Stock prices rose after news of McConnell’s offer.

Ahead of the White House meeting, the administration warned that if the borrowing limit isn’t extended, it could set off an international financial crisis that the United States might not be able to manage.

“A default would send shock waves through global financial markets and would likely cause credit markets worldwide to freeze up and stock markets to plunge,” the White House Council of Economic Advisors said in a new report. “Employers around the world would likely have to begin laying off workers.”

The recession that could be triggered might be worse than the 2008 financial crisis, because it would come as many nations are still struggling with the COVID-19 pandemic, said the report, first obtained by the New York Times.

To get around the standoff taking place in the Senate, Biden indicated in off-the-cuff comments Tuesday that Democrats were considering a change to Senate rules.

“It’s a real possibility,” he told reporters outside the White House.

But Manchin, who has for months resisted pressure from liberal activists to change the filibuster so that Democrats can advance legislation on other issues such as voting rights, appeared unmoved.

“I think I’ve been very clear,” Manchin told reporters. “Nothing changes.”

The conservative Democrat implored Senate Majority Leader Charles E. Schumer (D-N.Y.) and McConnell to work together to resolve the impasse.

Getting rid of the filibuster rule would lower the typical threshold to pass legislation from 60 votes to 50. With the Senate split 50-50, Vice President Kamala Harris could then break a tie, allowing Democrats to push past Republican opposition. But to succeed in changing the rules, all 50 Democratic senators would need to be on board.

Once a routine matter, raising the debt limit has become politically treacherous over the last decade or more, used by Republicans in particular to rail against government spending and the rising debt load, to which both parties have contributed.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.