Trump Organization convicted in executive tax dodge scheme

NEW YORK — Donald Trump’s company was convicted of tax fraud Tuesday for helping executives dodge taxes on lavish perks such as Manhattan apartments and luxury cars, in a significant repudiation of financial practices at the former president’s business.

A jury found two corporate entities at the Trump Organization guilty on all 17 counts, including conspiracy and falsification of business records. Trump was not on trial. The verdict came on the second day of deliberations.

The conviction is a validation for New York prosecutors who have spent three years investigating the former president and his businesses.

Manhattan Dist. Atty. Alvin Bragg said the verdict “underscores that in Manhattan we have one standard of justice for all.”

As punishment, the Trump Organization could be fined up to $1.6 million — a relatively small amount for a company of its size, though the conviction might make some of its future deals more complicated.

Trump, who recently announced he was running for president again, has said the case against his company was part of a politically motivated “witch hunt.” Speaking outside the courthouse, Trump Organization lawyer Alan Futerfas vowed to appeal.

Manhattan prosecutor challenges defense claims that former President Trump was unaware of the plot at the heart of the tax fraud case against the Trump Organization.

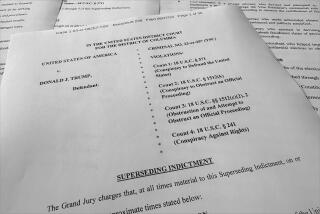

The verdict adds to already mounting legal woes for Trump, who faces a criminal investigation in Washington over the retention of top-secret documents at his Florida estate, Mar-a-Lago, as well as efforts to undo the results of the 2020 presidential election.

Those inquiries are being led by a newly named Justice Department special counsel. The district attorney in Fulton County, Ga., is also leading an investigation into attempts by Trump and his allies to overturn his loss in that state.

Although Trump was not charged, the verdict marks yet another setback for the former president, who has faced a series of self-inflicted crises since launching his third campaign for the White House last month.

That includes anger over his dinner with a Holocaust-denying white nationalist and the antisemitic rapper formerly known as Kanye West and an authoritarian call by Trump for the “termination of all rules, regulations, and articles, even those found in the Constitution” to address his baseless claims of mass election fraud.

The Manhattan district attorney’s case against the Trump Organization was built largely around testimony from the company’s former finance chief, Allen Weisselberg, who previously pleaded guilty to charges that he manipulated the company’s books and his own compensation package to illegally reduce his taxes.

Weisselberg testified in exchange for a promised five-month jail sentence.

To convict the Trump Organization, prosecutors had to convince jurors that Weisselberg or his subordinate, Senior Vice President and Controller Jeffrey McConney, were “high managerial” agents acting on the company’s behalf and that the company also benefited from Weisselberg’s scheme.

An appeals court has ruled that a lower court judge should not have appointed a special master to review documents seized in an FBI search of Trump’s home.

Trump Organization lawyers insisted that “Weisselberg did it for Weisselberg” throughout the monthlong trial. They contended Weisselberg had acted on his own and betrayed the company’s trust. No one in the Trump family or the company was to blame, they argued.

After Tuesday’s verdict, a company lawyer, Susan Necheles, repeated that argument.

“Why would a corporation whose owner knew nothing about Weisselberg’s personal tax returns be criminally prosecuted for Allen Weisselberg’s personal conduct, for which they had no visibility or oversight? This case was unprecedented and legally incorrect,” she said.

Though he testified as a prosecution witness, Weisselberg also attempted to take responsibility on the witness stand, saying nobody in the Trump family knew what he was doing.

“It was my own personal greed that led to this,” an emotional Weisselberg testified.

Manhattan prosecutors alleged the former president “knew exactly what was going on” with the scheme, though Trump and the company’s lawyers have denied that.

Weisselberg, who pleaded guilty to dodging taxes on $1.7 million in fringe benefits, testified that he and McConney conspired to hide that extra compensation from his income by deducting their cost from his pretax salary and issuing falsified W-2 forms.

During his closing argument, prosecutor Joshua Steinglass attempted to refute the claim that Trump knew nothing about the scheme. He showed jurors a lease Trump signed for Weisselberg’s company-paid apartment and a memo Trump initialed authorizing a pay cut for another executive who got perks.

The Supreme Court denied former President Trump’s plea to shield his tax returns from being turned over to a House committee.

“Mr. Trump is explicitly sanctioning tax fraud,” Steinglass argued.

The verdict doesn’t end Trump’s battle with Bragg, a Democrat who took office in January.

The district attorney has said that a related investigation of the former president that began under his predecessor, Dist. Atty. Cyrus Vance Jr., is “active and ongoing.”

In that wide-ranging inquiry, investigators have examined whether Trump misled banks and others about the value of his real estate holdings, golf courses and other assets — allegations at the heart of New York Atty. Gen. Letitia James’ pending lawsuit against the former president and his company.

The district attorney’s office has also investigated whether state laws were broken when Trump’s allies made payments to two women who claimed to have had affairs with Trump years ago.

Near the end of his tenure last year, Vance directed deputies to present evidence to a grand jury for a possible indictment of Trump. After taking office, though, Bragg let that grand jury disband so he could give the case a fresh look.

On Monday, he confirmed that a new lead prosecutor had been brought on to handle that investigation, signaling that it was still active.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.