What should borrowers do now that Biden’s college debt forgiveness plan is dead?

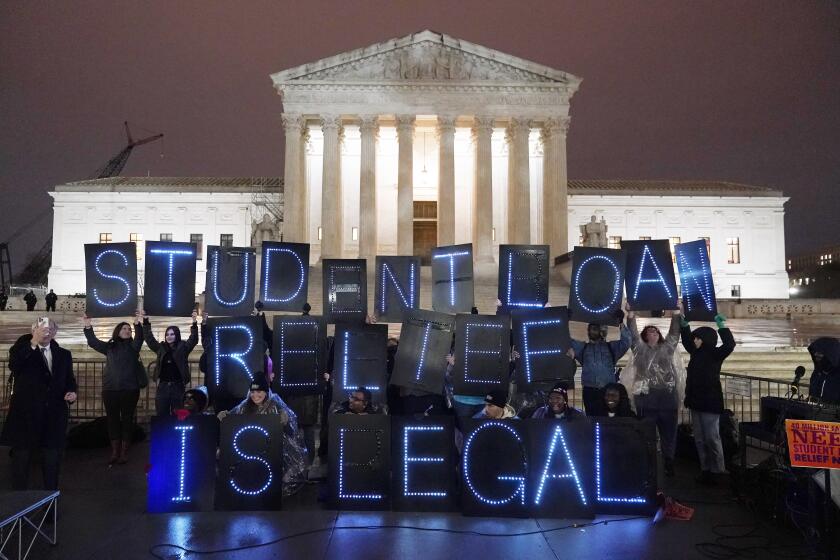

After months of anxious waiting for the courts to decide whether President Biden could forgive billions of dollars in student loan debt, borrowers finally have their answer: No.

The Supreme Court’s decision in Biden vs. Nebraska won’t make the lives of more than 3.8 million borrowers in California any easier. But with debt payments set to resume in two months, you at least have options now that could make the monthly toll more affordable.

The justices’ 6-3 ruling, which focused on the specifics of the debt relief program and the law used to justify it, doesn’t preclude the administration from trying a different way to provide forgiveness. President Biden plans to do just that; the White House said Friday that the Education Department started developing a new rule under the Higher Education Act “aimed at opening an alternative path to debt relief for as many borrowers as possible.”

The high court’s majority, however, suggested that Congress would have to approve loan forgiveness on the scale sought by borrower advocates. And with House Republicans having passed a resolution opposing the loan forgiveness program and the pause in debt payments, it’s clear that borrowers won’t be getting blanket relief from Congress this session.

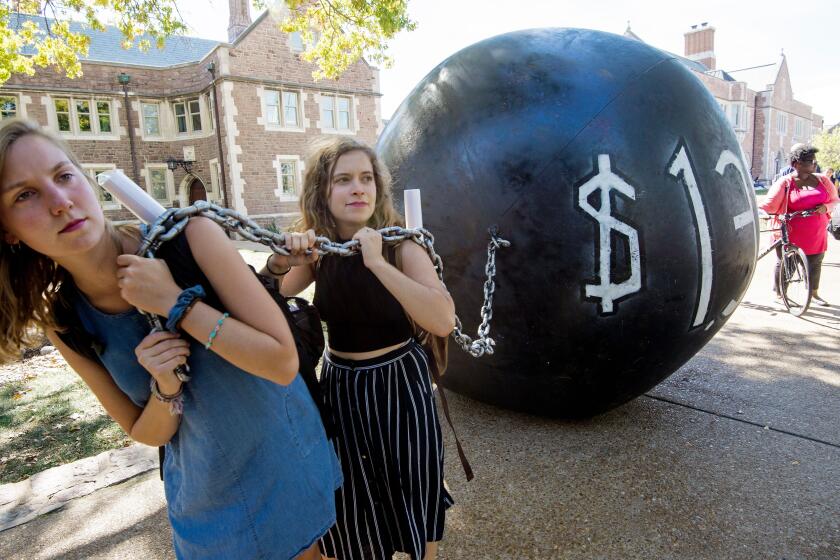

According to the Education Data Initiative, almost 10% of California residents have student loan debt. All told, Californians owe $142 billion, or an average of $37,084 per borrower.

Biden’s program would have erased $10,000 in federal student loan debt for every borrower who earned less than $125,000 (or, for couples filing joint tax returns, less than $250,000 per household). The program would have forgiven an additional $10,000 in debt for qualified borrowers who had received Pell Grants, a form of financial aid for lower-income students.

Here are some steps that borrowers can take to make the shift back to monthly loan payments less painful.

The Supreme Court has ruled that President Biden does not have the authority to forgive millions of student loans.

What you should do now

The Biden administration had long planned to lift the moratorium on federal student loan payments 60 days after the Supreme Court ruled, and no later than the end of August. In the compromise struck to lift the debt ceiling, however, Congress ordered interest charges to resume at the end of August regardless of when the justices rule. Now, the Education Department’s financial aid site, studentaid.gov, is telling borrowers that interest will start to accrue on their loans on Sept. 1, and payments will be due again the next month.

The Education Department says it will send borrowers a billing statement at least three weeks in advance, telling them when their payment is due and how much they owe. So if you haven’t done so already, you should confirm your contact information at the Federal Student Aid website, studentaid.gov.

You should also determine which company is servicing your federal loan or loans so you’ll know whom to pay. Jaylon Herbin, director of federal campaigns for the Center for Responsible Lending, said there has been a lot of turnover among loan servicers in the 38 months since borrowers were last required to make a payment.

To find out who is servicing your loan, go to your account at studentaid.gov and select the “My Loan Servicers” list, or call the Federal Student Aid Information Center at (800) 433-3243.

Next, confirm how much you still owe and what the interest rates are on your loans. You can call your servicer to get its figures, or you can log in to your account at studentaid.gov and check the numbers there. Make sure the record shows all the payments you’ve made. If it doesn’t, call your servicer and point out which payments are missing. And if that doesn’t fix the problem, file a complaint with the Education Department.

The federal government plans to forgive up to $20,000 in student loan debt for millions of Americans. Here’s everything you need to know.

What if I’m not able to start paying again?

That’s not good, but the Education Department announced a new effort Friday to make the consequences less painful.

From October 2023 until September 2024, the department won’t impose most of the penalties associated with missing or underpaying a monthly payment. It’s only a bandage, though; you will eventually have to pay the missed amounts.

The department said it won’t add the unpaid interest payments to your principal at the end of the 12 months, which means your loan amount won’t grow. Nor will it report the missed or partial payments to credit bureaus, declare loans to be in default or garnish your wages during the “on-ramp” period.

This relief will be provided automatically, the department said. “Borrowers who can pay should do so, but this on-ramp period gives borrowers who cannot make payments right away the necessary time to adjust, enabling them to ultimately make their monthly payments and meet their financial obligations on their loans,” the White House said in a statement.

The Supreme Court has blocked Biden’s debt forgiveness plan, depriving his administration of a key tool to help borrowers begin repayment.

Will the moratorium affect monthly payments?

The short answer is no.

Although interest rates are considerably higher now than they were before COVID-19, the rate on federal student loans is typically set when the loans are obtained. For example, a federal direct loan taken out by an undergraduate between July 2011 and June 2013 will always have an interest rate of 3.4%, and one taken out between July 2015 and June 2016 will always have a rate of 4.29%. The exception is federal Perkins loans, all of which carry a 5% interest rate.

Granted, if you were on a graduated repayment plan, you may have to pay more now than you did before the pause. That’s because your payment amount is recalculated after every two years of repayments, and you may be due for an increase.

If you are on a standard repayment plan, which requires you to pay your loans back in 10 years, the pause in payments also stopped the clock on your loan, the Education Department says. You’ll still have to make the equivalent of 120 monthly payments all told. The same is true for extended plans that have a 25-year payoff period, which require the equivalent of 300 monthly payments.

If you are on an income-based payment plan, your annual income and family size will still determine how much you pay each month. So if your income hasn’t changed since 2019, your payments will be the same as they were in 2020. During the payment pause, however, the department gave you credit for each month as if you’d kept making payments. As a result, the clock did not stop on the time you’ll be required to continue making payments. Most loans will still be paid off in 20 to 25 years, or 10 years for public-sector or nonprofit workers in the Public Service Loan Forgiveness Program.

Totally Worth It

Be your money's boss! Learn how to make a budget and take control of your finances with this eight-week newsletter course.

You may occasionally receive promotional content from the Los Angeles Times.

What about borrowers in default?

Federal direct student loans and Federal Family Education Loans go into default when a borrower is more than 270 days behind on payments. And the consequences are severe — among other things, the feds can take your tax refunds and a chunk of your paycheck.

During the pandemic-related pause on monthly payments, though, the Education Department halted debt collection from borrowers in default. That collection will resume next year, the department says, unless borrowers claim a Fresh Start, a one-time chance to start making payments again as if they’d never fallen behind. The Fresh Start program offers to restore borrowers who defaulted on federal direct, FFEL or federally held Perkins loans to good standing in 10 minutes or less.

If you are in default, borrower advocates say, there is no reason not to take advantage of the opportunity to clean your slate. Not only will you avoid having your pay garnished, you’ll also be able to obtain new loans if you want to return to school — many borrowers in default left before they earned the degree or certificate they were seeking.

But Jessica Thompson, vice president of the Institute for College Access & Success, said borrowers need to sign up for a new repayment plan to reap the full benefit of Fresh Start. If they’re still in tough financial straits, they may qualify for an income-driven plan with monthly payments as low as $0, she said.

The Education Department advises borrowers in default who are interested in Fresh Start to contact the agency or company that holds their student loans and set up a payment plan. If the department holds the loans, borrowers can get in touch online, by phone or by mail; see the contact information on the Fresh Start site. If it’s a guarantee agency, contact information is available at studentaid.gov. And if you don’t know who holds your loans, you can call the department at (800) 621-3115 (TTY 1-877-825-9923) to find out.

As the amount of student loan debt continues to grow, more and more borrowers are seeking alternative ways to get relief. But many companies promising to help are just trying to exploit borrowers’ desperation.

What other changes could help borrowers?

The administration announced Friday that it has finalized its proposal to make the income-based Revised Pay As You Earn repayment plan significantly more affordable. Renamed the Saving on a Valuable Education plan, it is expected to cut qualified borrowers’ monthly payments by more than half.

Income-based plans are designed to reduce debt payments for struggling borrowers by basing those payments on what they earn, rather than the size of the loan. After 20 to 25 years of monthly installments, whatever amount they still owe is forgiven.

The biggest benefit offered by the SAVE plan is that it cuts monthly payments for undergraduate borrowers from 10% of the borrower’s discretionary income to 5%. Borrowers who also took out loans in graduate school will pay between 5% and 10%, depending on how much of their debt is undergraduate loans. The reduction will not go into effect until July 1, 2024, however.

In the meantime, the administration plans to increase the amount of income considered non-discretionary by 50%. The result, according to the administration, is that a single borrower who makes less than $32,800 a year would have a monthly payment of $0. The administration estimates that more than 1 million borrowers fall into that category.

One other immediate benefit: Borrowers on the SAVE plan whose monthly payments aren’t large enough to cover the interest their loan is accruing will not have that interest added to their loans. Under other income-driven repayment plans, borrowers who stay current can still see their debt grow as a consequence of unpaid interest.

Once the plan goes into full effect, it will also offer speedier forgiveness for those who borrowed less. Ten years of repayments would be required for anyone who borrowed $12,000 or less; for each additional $1,000 borrowed, 12 more monthly payments would be required.

The Education Department has taken one other step that will hasten debt forgiveness for many people enrolled in income-driven repayment plans or the Public Service Loan Forgiveness Program.

The public-service program forgives a borrower’s loans after 10 years of monthly payments made while they’re working at a government agency or a nonprofit. You can be enrolled in both an income-driven plan and the public-service forgiveness program.

Last year, the administration announced that it would give these borrowers credit for the payments they’d made while enrolled in some other repayment plans that hadn’t previously qualified. They were also credited for the months spent in forbearance, if they were in forbearance for at least 12 consecutive months or at least three years overall, as well as the months their loans were in deferment after the borrower left school.

In addition, these borrowers will receive credit for all of the months that payments were suspended during the pandemic.

Those adjustments, which the department said it would make automatically, are expected to bring millions of borrowers closer to having their loans forgiven. Borrowers who will have enough monthly payments to qualify for debt forgiveness right away will have their balances forgiven before payments resume, the department’s website says. And those who will have more than the required number of payments after their accounts are adjusted will receive refunds.

The adjustments are available only to borrowers whose loans were issued directly or are held by the Education Department, and in some cases, only to borrowers with direct federal loans (that is, not FFEL program loans). But borrowers with FFEL, Perkins or Health Education Assistance Loan Program loans can qualify for all the applicable adjustments if they apply to combine them into a federal direct consolidation loan by the end of this year.

One other key point: If you switch to an income-driven repayment plan, you’ll get credit for all your previous monthly payments on your federal loans, along with the adjustments listed above.

Similarly, if you hadn’t enrolled in the Public Service Loan Forgiveness Program, you can apply for that program and get credit for all payments you made on qualifying federal loans while working in government or for a nonprofit. To see whether you’re eligible, visit studentaid.gov/pslf.

With its plan for student debt relief on hold, the Biden administration is pressing ahead on a second front: Slashing monthly payments for more borrowers with relatively low incomes while holding down unpaid balances.

Consider a new repayment plan

You can switch from one repayment plan to another on studentaid.gov with no fees, but there can be a cost. Any unpaid interest will be “capitalized” — that is, folded into the balance of your loan, thus increasing the amount of interest you’ll accrue every month.

Nevertheless, there may be good reasons to switch. A standard plan with a 10-year repayment period could have a lower total cost than a 20- or 25-year repayment plan tied to your income, simply because the interest charged will be considerably lower. The monthly payments on the standard plan, though, would be higher — potentially much higher.

If you’re on a 10-year repayment plan and the looming resumption in payments seems unaffordable, there are a few options.

One is to switch to an extended payment plan that stretches your monthly payments out over 25 years. Another is to switch to an income-based plan, such as the SAVE plan.

Be forewarned: The federal government will tax any amount of loan forgiveness received after Dec. 31, 2025. The tax bill, however, probably would pale in comparison to the amount of debt discharged.

The Education Department offers an online loan simulator to help you explore your options.

Greg Ward, director of the Financial Wellness Think Tank at El Segundo-based Financial Finesse, said it’s also a good idea to talk to your employer about benefits that it might offer student-loan borrowers. Companies are starting to offer loan repayment assistance, he said, and a new federal law will allow employers to contribute the same amount to workers’ retirement accounts as workers pay for their student loans, starting in 2024.

“Employers recognize that this is something that affects a lot of workers, especially younger workers,” affecting their health and productivity, he said. The new benefits “are things that you certainly want to bring to their attention,” he added.

One other bit of advice Ward offered was to go over your options with a financial professional. If you have access to a financial coach, a student-loan counselor or other advisor, you should discuss your options with them and evaluate “where you are personally in terms of your career, family aspirations and other factors like that.”

Deciding how to spend your first paycheck after graduating from college can be overwhelming, given the many competing demands on it.

What if I still can’t afford the monthly payments?

The very last thing you want to do, said Abby Shafroth of the National Consumer Law Center, is default. So if you’re still in a bind after changing your repayment plan, she said, you have two other, last-ditch options that you can seek from your servicer: deferment and forbearance.

“Deferment is generally better than forbearance, particularly if you have any subsidized loans [which most borrowers from low-income families do], because interest isn’t charged on subsidized loans during deferments,” said Shafroth, a senior attorney at the center. You’ll have to apply for a deferment from your servicer, however, and prove that your situation fits one of the available categories, such as economic hardship or active-duty military service.

In a deferment, you won’t have to make any payments for a set period of time, but you’ll still owe the full amount of the loan, and interest will keep accruing on your non-subsidized loans. If you don’t make payments on the interest during the deferment period, the unpaid amount will be tacked onto your loan balance.

Forbearance works in a similar way, suspending your monthly payments for a year (or more, if you reapply) without reducing your debt. Interest charges will continue throughout, meaning you will owe more after your forbearance ends than you did when it began. In some situations, loan servicers must grant you forbearance; these include being on active National Guard duty or working as a medical or dental intern or resident. Servicers also have the option of granting forbearance to borrowers experiencing financial hardship or those who are otherwise in need.

Both deferment and forbearance are available for federal direct loans, FFEL program loans and, in many circumstances, Perkins loans.

Just say no to anyone offering to help you obtain the $10,000 to $20,000 in student loan debt forgiveness. You don’t need them.

About The Times Utility Journalism Team

This article is from The Times’ Utility Journalism Team. Our mission is to be essential to the lives of Southern Californians by publishing information that solves problems, answers questions and helps with decision making. We serve audiences in and around Los Angeles — including current Times subscribers and diverse communities that haven’t historically had their needs met by our coverage.

How can we be useful to you and your community? Email utility (at) latimes.com or one of our journalists: Jon Healey, Ada Tseng, Jessica Roy and Karen Garcia.

More to Read

Totally Worth It

Be your money's boss! Learn how to make a budget and take control of your finances with this eight-week newsletter course.

You may occasionally receive promotional content from the Los Angeles Times.