Student loan forgiveness: A comprehensive guide

The Supreme Court has ruled that President Biden does not have the authority to forgive millions of student loans.

The Supreme Court has ruled against the Biden administration’s blanket college loan forgiveness plan, denying debtors the instant relief the program offered. But they still have better options for managing their debt than they did before the court took up the case.

Advocates are scrambling to get the word out to public service workers that they could be eligible for a federal program that could wipe out or reduce student loan debt.

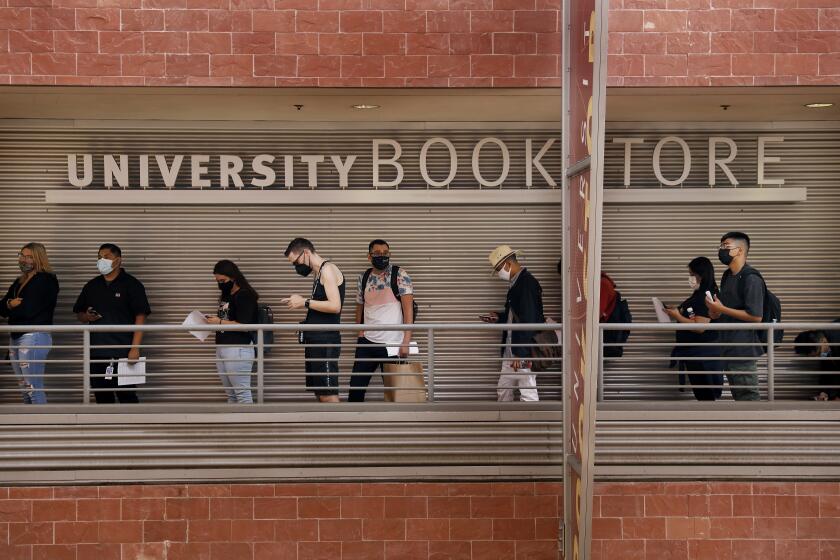

After a payment pause that has lasted more than three years, more than 40 million student loan borrowers will be on the hook for payments starting in late August.

As the amount of student loan debt continues to grow, more and more borrowers are seeking alternative ways to get relief. But many companies promising to help are just trying to exploit borrowers’ desperation.

Just say no to anyone offering to help you obtain the $10,000 to $20,000 in student loan debt forgiveness. You don’t need them.

The Supreme Court’s conservatives argue that only Congress could approve such a large amount of federal spending on student loans.

Republican-appointed judges have kept President Biden’s student debt relief plan from taking effect. Here’s where things stand ahead of Tuesday’s hearing.

With its plan for student debt relief on hold, the Biden administration is pressing ahead on a second front: Slashing monthly payments for more borrowers with relatively low incomes while holding down unpaid balances.

A federal judge threw out Biden’s student loan forgiveness program. The Education Department plans to appeal, but the program is on hold in the meantime.

The White House said Pell Grant recipients would receive twice as much loan forgiveness as other low- and moderate-income borrowers. Do you qualify? Check the Federal Student Aid website.

Will debt relief for student loans be taxable in California? Experts say yes, but the state Franchise Tax Board isn’t giving a definitive answer.

As the amount of student loan debt continues to grow, more and more borrowers are seeking alternative ways to get relief. But many companies promising to help are just trying to exploit borrowers’ desperation.

The U.S. Department of Education launched the official application form Monday for student-loan borrowers for debt relief after a trial run over the weekend.

The Biden administration’s student loan relief plan is expected to wipe out the debt of 1 million or more Californians. Here’s who is eligible and for how much forgiveness.

President Biden’s loan forgiveness plan papered over some of the financial aid complexities. Here’s how to figure out if your loan may be eligible.

For details of the plan to forgive up to $20,000 in student loan debt, listen to a Twitter Spaces conversation hosted by Times journalists.

Rep. Eric Swalwell of the Bay Area has spent years pushing legislation to forgive student loan interest and set rates to zero.

The federal plan would forgive up to $20,000 in student loans for Pell Grant recipients and $10,000 for other borrowers earning less than $125,000 a year.

President Biden has decided to forgive some student debt. The political fallout could be significant.

The Biden administration updated its guidance Thursday about which loans would be eligible for up to $20,000 in forgiveness, closing the door to some borrowers.

Some Democrats wanted President Biden to cancel up to $50,000 per borrower of college debt, but that was seen as too costly for the government.