Halfway through Medicaid purge, enrollment is down about 10 million

Halfway through what will be the biggest purge of Medicaid beneficiaries in a one-year span, enrollment in the government-run health insurance program is on track to return to roughly pre-pandemic levels.

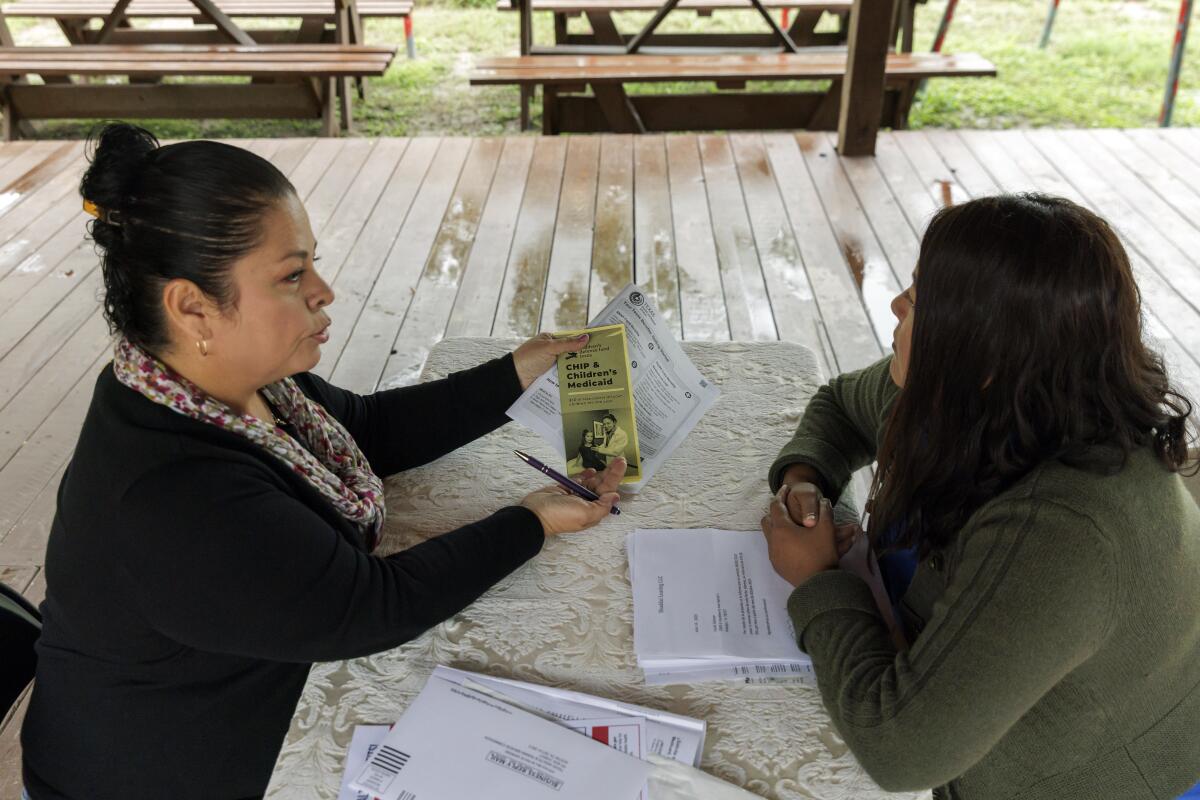

Medicaid, which covers low-income and disabled people, and the related Children’s Health Insurance Program, known as CHIP, grew to a record 94 million enrollees as a result of a rule that prohibited states from terminating coverage during the nation’s COVID-19 public health emergency.

But since April, states have removed more than16 million people from the programs in a process known as the “unwinding,” according to KFF estimates compiled from state-level data.

While many beneficiaries no longer qualify because their incomes rose, millions of people have been dropped from the rolls for procedural reasons such as failing to respond to notices or return paperwork. But at the same time, millions have been reenrolled or signed up for the first time.

The net result: Enroll-ment has fallen by about9.5 million people from the record high in April, according to KFF. That puts Medicaid and CHIP enrollment on track to look, by the end of the unwinding this year, a lot like it did at the start of the pandemic: about 71 million people.

“What we are seeing is not dissimilar to what we saw before the pandemic — it is just happening on a bigger scale and more quickly,” said Larry Levitt, executive vice president for health policy at KFF.

Next year, California will extend Medi-Cal benefits to the last group of undocumented people who have been left out of the program — those ages 26 to 49 — in what is expected to be its biggest expansion of coverage since the rollout of the Affordable Care Act.

Enrollment churn has long been a feature of Medicaid. Before the pandemic, about 1 million to 1.5 million people nationwide fell off the Medicaid rolls each month — including many who qualified but failed to renew their coverage, Levitt said.

During the unwinding, many people have been disenrolled in a shorter time. In some ways — and in some states — it’s been worse than expected.

The Biden administration predicted about 15 million people would lose coverage under Medicaid or CHIP during the unwinding period, nearly half due to procedural issues. Both predictions have proved low. Based on data reported so far, disenrollments are likely to exceed 17 million, according to KFF — 70% due to procedural reasons.

But about two-thirds of the 48 million beneficiaries who have had their eligibility reviewed so far got their coverage renewed. About one-third lost it.

The federal government has given most states 12 months to complete their unwinding, starting with the first disenrollments last year between April and October.

Timothy McBride, a health economist at Washington University in St. Louis, said the nation’s historically low unemployment rate means people who lose Medicaid coverage are more likely to find job-based coverage or be better able to afford plans on Obamacare marketplaces. “That is one reason why the drop in Medicaid is not a lot worse,” he said.

There are big differences among states. Oregon, for example, has disenrolled just 12% of its beneficiaries. Seventy-five percent have been renewed, according to KFF. The rest are pending.

At the other end of the spectrum, Oklahoma has dumped 43% of its beneficiaries in the unwinding, renewing coverage for just 34%. About 24% are pending.

California will soon require Medi-Cal recipients to prove their eligibility again. But it has a safety net for people who lose their coverage.

States have varying eligibility rules, and some make it easier to stay enrolled. For instance, Oregon allows children to stay on Medicaid until age 6 without having to reapply. All other enrollees get up to two years of coverage regardless of changes in income.

Jennifer Harris, senior health policy advocate for Alabama Arise, an advocacy group, said that her state’s Medicaid agency and other nonprofit organizations communicated well to enrollees about the need to reapply for coverage and that the state hired more people to handle the surge. About 29% of beneficiaries in Alabama who’ve had eligibility reviews were disenrolled for procedural reasons, KFF found. “Things are even-keel in Alabama,” she said, noting that about 66% of enrollees have been renewed.

State officials have told the Legislature that about a quarter of people disenrolled during the unwinding were reenrolled within 90 days, she said.

One of a few states that have refused to expand Medicaid under the Affordable Care Act, Alabama had about 920,000 enrollees in Medicaid and CHIP in January 2020. That number rose to about 1.2 million in April 2023.

More than halfway into the unwinding, the state is on track for enrollment to return to pre-pandemic levels, Harris said.

Joan Alker, executive director of the Georgetown University Center for Children and Families, said she remains worried the drop in Medicaid enrollment among children is steeper than typical. That’s particularly bothersome because children usually qualify for Medicaid at higher household income levels than their parents or other adults.

California is weighing new continuous-enrollment policies for children up to age 5 who rely on Medicaid. They’d keep their coverage even if their household income changes.

During the unwinding, 3.8 million children have lost Medicaid coverage, according to the center’s latest data. “Many more kids are falling off now than prior to the pandemic,” Alker said.

And when they’re dropped, many families struggle to get them back on, she said. “The whole system is backlogged and the ability of people to get back on in a timely fashion is more limited,” she said.

The big question, Levitt said, is how many of the millions of people dropped from Medicaid are now uninsured.

The only state to survey those disenrolled — Utah — discovered about 30% were uninsured. Many of the rest found employer health coverage or signed up for subsidized coverage through the Affordable Care Act marketplace.

What’s happened nationwide remains unclear.

KFF Health News, formerly known as Kaiser Health News, is a national newsroom that produces in-depth journalism about health issues.