ORANGE COUNTY PERSPECTIVE

SAN FRANCISCO — In the opening of the largest utility bankruptcy case in U.S. history, dozens of high-priced lawyers squeezed into a packed courtroom Monday to have a say in how Pacific Gas & Electric Co. will be allowed to spend its cash.

Attorneys for gas suppliers told U.S. Bankruptcy Judge Dennis Montali that they are worried that PG&E; might not pay their gas bills, which run into the tens of millions of dollars. Montali, who had read all the legal documents before the hearing, pointedly advised lawyers for PG&E; to spiff up their legal briefs and get their court citations right.

As Montali addressed a PG&E; lawyer, a consumer activist marched uninvited to the court podium to read the judge a letter. Montali told her to sit down.

Although the motions before the court were relatively routine--Montali approved temporary orders that allow PG&E; to pay many of its bills--the atmosphere was tense as the high-stakes bankruptcy reorganization got underway.

PG&E; asked the bankruptcy judge for an injunction against accounting changes ordered March 27 by the Public Utilities Commission. The utility said the changes prevented a customer rate freeze from being lifted. The skirmish, scheduled to be heard on April 18, represents the utility’s first attempt to get higher electricity rates through the bankruptcy proceeding, attorneys said.

In the coming months, the huge, complicated case will bring hundreds of seasoned lawyers together as they try to restructure the finances of a company that is more than $9 billion in debt.

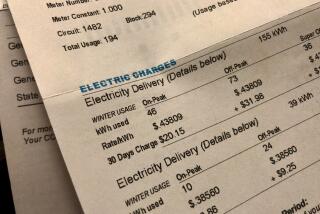

Consumers are watching closely to see whether Montali allows PG&E; to raise electricity rates, which state regulators have already increased by as much as 46% for some customers. The state has predicted more blackouts, and gas charges have spiraled upward for months.

Monday’s hearing was held in the federal Bankruptcy Court, blocks from the federal courthouse, on a top floor of a high-rise in the city’s busy financial district.

Lawyers for a variety of creditors were led into the courtroom first and filled the front rows. Activists filled the rear and seats in the jury box.

Even without the seating plan, it was easy to tell who was who. The activists, many of them women, were distinctly less formal than the lawyers and appeared less impressed by the proceedings. Some of them glared at the lawyers.

The hearing began when Montali heard from an East Coast attorney, who spoke by telephone to the courtroom representing Bank of New York for PG&E; bondholders, who are owed more than $2.2 billion.

The proceeding on the emergency motions was intended to allow PG&E; to pay its suppliers and other creditors without interruption. The judge will make a final decision on the motions May 9, a day after the first major court session of PG&E;’s creditors.

Early in a bankruptcy proceeding, it is rare for a judge not to allow the debtor to spend cash that is pledged to others as collateral. It is usually the only way for the company to continue operating. But as the case wears on, the standards for allowing expenditures become increasingly stringent, lawyers said.

PG&E; attorney James L. Lopes, speaking in court, sought to reassure the public and creditors of the utility’s good faith.

He said PG&E; believes the state PUC erred in calculating how much the utility must pay the state for the electricity it is buying for customers.

Lopes added that PG&E; continues to make payments because “it’s very important to the state and their ongoing procurement of power.” However, he said the utility reserves the right to challenge the formula for the payments at a later date.

The attorney also stressed that gas suppliers will be paid because the utility can pass on to consumers higher gas prices. Only electrical prices are capped. He said the utility is confident of a steady supply of gas for the next several months.

“There isn’t going to be a default,” he insisted.

Montali said that PG&E;’s “sanguine” reassurances may not be enough to comfort creditors and told the utility lawyer that he expected PG&E; to provide many more specific numbers about its financial affairs. However, he approved a temporary order allowing the utility to pay its gas suppliers.

Adam A. Lewis, a lawyer for a gas supplier, underscored the concern of creditors when he talked about the enormous sums involved.

Lewis, who represents El Paso Merchant Energy, said its bill to PG&E; just for March and part of April was $50 million. The monthly payment before that was $60 million, he said.

Considering the staggering amounts, “it doesn’t take very long for something to go drastically wrong,” Lewis said.

Montali, addressing these concerns, made it clear that he cannot single-handedly solve the energy crisis. “I have no control” over the future price of gas, he said.

Elsewhere on Monday, PG&E; announced it would pay only half the nearly $80 million in utility property taxes due today to 49 California counties. A PG&E; spokesman said bankruptcy laws allow the utility to pay only for the period following its bankruptcy filing and that the utility will ask the court in a few days for permission to pay the rest of its bill.

One of the nation’s major debt-rating agencies, Standard & Poor’s Corp., lowered its rating Monday on PG&E;’s unsecured debt--money owed that is not secured by any collateral--to “default” status. Another major debt-rating company, Moody’s Investors Service, took no immediate action as a result of the bankruptcy filing.

Monday’s court hearing attracted many lawyers curious about Montali’s debut as the ringmaster of the gigantic case and to see who was representing other parties in the case.

“People were really there to do the talking in the hallways,” one lawyer said later.

Montali, a former bankruptcy lawyer appointed to the bench in 1993, was extremely active during the hearing, peppering lawyers with comments and questions.

When he complained of ambiguities in PG&E;’s legal documents, he prefaced his remarks by saying he did not mean to criticize. He said he understood the time pressures the lawyers were under.

Asking for clarification of some numbers, Montali told PG&E;’s Lopes: “That is something to put on your short to-do list.” Montali added to that list as the hearing wore on for more than an hour.

The judge also expressed weariness with PG&E;’s recitation of the history of the crisis in legal document after legal document. Could the lawyers indicate that background in italics or something “so the poor judge doesn’t have to read it 175 times?” Montali asked.

“Your Honor,” Lopes replied, “I am getting tired of reading it as well.”

At one point, a cell phone rang in the courtroom. Montali sternly announced that it would be removed if it rang again.

Lopes quickly bent down and began to rummage in his briefcase. “You scared me,” he said, confessing he could not remember whether he had turned off his phone.

He had. “It’s off,” he said, relieved.

Without missing a beat, Montali told his clerk: “Get me Jim Lopes on the phone.”

For many of the spectators, being in the courtroom was like being in a foreign country. The judge and lawyers spoke in bankruptcy jargon that consumer activists later complained they could not understand.

When Montali noted that he might move the case to a larger courtroom to accommodate the crowds, Lopes said the numbers would fall off once people see “how boring these hearings are.”

Just as Montali and Lopes began to discuss future hearing dates, consumer activist Medea Benjamin jumped from her seat and strode over to the podium to address the judge.

“You interrupted me,” Montali admonished her. “Now go back and sit down, and I’ll let you make a statement in a minute.”

When he allowed her to speak later, she asked whether there was some way consumers could be briefed about what was happening at the hearing because it was “a little bit above our heads.”

“Yes,” Montali said. “Hire a bankruptcy lawyer.”

Benjamin, of the Coalition for Public Power Now, then read her letter. She begged Montali not to raise utility rates and urged him to force PG&E;’s parent company to assume the financial burden.

“We have great faith in you,” she concluded. “Please don’t let us down.”

*

Times staff writers James Peltz and Tim Reiterman contributed to this story.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.