A new brand of moneyball

The $2.15-billion sale of the Dodgers baseball franchise to a group led by former Lakers star Magic Johnson was a cash deal that will not add to the team’s debt load but could lead to a payoff of as much as $1 billion for previous owner Frank McCourt, according to people familiar with the deal.

The price tag is a record for a professional sports team, and now fans will be watching to see if the Johnson group has any money left over to upgrade the roster and renovate aging Dodger Stadium.

“There’s a real challenge ahead for Dodger fans to be vigilant about,” said Andrew Zimbalist, an economics professor at Smith College in New York and author of “Baseball and Billions.” “We’ll have to wait and see what happens.”

Johnson did not shy away from comparisons to baseball’s biggest spenders, including the New York Yankees and crosstown Angels.

“It’s not just the Yankees,” Johnson said. “The Angels invested a lot of money into Albert Pujols and C.J. Wilson. You see what the Tigers just did with Prince Fielder. Teams are investing. That’s what you do when you put a winning team on the field. We’re not going to be any different from those teams.”

Zimbalist was among many noted sports economists who expected the team to sell for $1.3 billion to $1.6 billion. Previously, the Miami Dolphins of the NFL sold for $1.1 billion and the British soccer club Manchester United for $1.47 billion.

The Chicago Cubs set the previous record for Major League Baseball at $845 million.

The Dodgers purchase price includes about $1.6 billion for the team and about $400 million that will go toward paying off debts incurred by the struggling organization. In addition, the new owners and McCourt will enter a joint $150-million venture to control the parking lots surrounding the stadium.

Economists weren’t the only ones taken aback by the offer from the Johnson group, which includes longtime baseball executive Stan Kasten and movie executive Peter Guber and which got most of its money from a Chicago financial services firm.

Mark Walter, chief executive officer of Guggenheim Partners, will be the controlling partner.

Bud Selig, commissioner of MLB, said in a statement that it was “extraordinarily exciting” for baseball to have a trio such as Johnson, Walter and Kasten at the controls of a flagship franchise.

Of Johnson, he said, “I believe that a man of Magic’s remarkable stature and experience can play an integral role for one of the game’s most historic franchises, in a city where he is revered.”

The new owners were among three finalists expected to face off in a private auction overseen by the U.S. Bankruptcy Court. All three were asked to submit preliminary bids earlier this week.

Hedge-fund billionaire Steven Cohen and biotech billionaire Patrick Soon-Shiong offered $1.35 billion, according to people close to the deal who were not authorized to speak publicly about it. The initial bids from St. Louis Rams owner Stan Kroenke and the Guggenheim partners were about $1.5 billion and $1.6 billion, respectively.

Each of the groups had already been vetted and approved by baseball owners, and when the Guggenheim partnership kicked its offer to $2 billion, the bidding was abruptly over. After McCourt realized Johnson and his group had far outbid the others, he agreed to sell and court-appointed mediator Joseph Farnan quickly signed off on the deal without giving the other groups a chance to match.

The sale now must be confirmed in a Bankruptcy Court hearing April 13. The transaction is scheduled to close by April 30, the same day McCourt must pay his former wife, Jamie, $131 million in a divorce settlement.

McCourt, who had wanted a court-directed proceeding as opposed to a Major League Baseball sale, stands to make a big profit.

According to court documents, his team has piled up $573 million in debts and about $200 million in tax liabilities.

With the parking-lot venture and divorce settlement figured in, McCourt -- who bought the team in a highly leveraged deal for $430 million in 2004 -- could clear roughly $1 billion.

The former owner had angered fans by raising parking prices early in his tenure. Now, the parking lot portion of the deal ensures that he can retain partial ownership of the lots and share in any future development revenue.

But, according to the deal, McCourt will not have control over the lots, and all of the money that fans pay to park at games will go to the new ownership group.

To some degree, people in and around the pro sports industry were expecting a blockbuster deal.

“You’re talking about one of the beachfront properties in American sports today,” said Neal Pilson, former president of CBS Sports. “Rarely do these huge sports brands become available.”

The value of all pro teams has risen over the last decade with the emergence of regional sports networks.

Americans used to watch their games on weekend afternoons, tuning to a national network. Then came the cable giants such as ESPN. Now, regional networks run by the likes of Fox Sports, Comcast and Time Warner Cable are competing -- and paying dearly -- for the right to broadcast local teams in their home areas.

With Time Warner Cable, Fox and others expected to show interest, experts predict the Dodgers, whose current contract runs through the 2013 season, could attract as much as $4 billion for their next deal, if the franchise is willing to sign a long-term contract.

The team could also start its own regional sports network -- or leverage the threat to do so in order to drive up the bidding.

“The price tag on the team ... apparently means the buyers know something is around the corner to get back that money,” said Matt Balvanz, director of analytics at Navigate Research, a Chicago sports marketing firm.

Pro team owners also know their asset has a very good chance of appreciating. Just ask McCourt, whose franchise struggled on the field and ended up in bankruptcy, yet more than quadrupled in value.

“The sports industry is not recession-proof, but it certainly is recession-resistant,” said J.C. Bradbury, author of “The Baseball Economist: The Real Game Exposed.” “It’s still cheap to watch on television or go to one game.”

In his statement, Selig said the number of bidders who were interested and the eventual price tag were “profound illustrations of the great overall health of our industry.”

The Dodgers might have another built-in value -- their ballpark.

“In the world of real estate, it’s location, location, location,” said Robert Bridges, an assistant professor of clinical finance and business economics at the USC Marshall School of Business. “Dodger Stadium is certainly one of the prime locations in the city.”

The team could follow the lead of L.A. Live, across the street from Staples Center, by adding restaurants and shops. There could be a hotel or even a baseball museum, Bridges said.

And if the Dodgers ever decide to move to another part of the city, the property they leave behind “is relatively easy to develop [because] the parking lots are largely graded.”

Any construction would have to be approved by the new ownership and McCourt. The Johnson group has given no indication that it is focused on anything other than baseball at the moment.

Having already paid a record price, the buyer’s cost of assembling and maintaining a winner on the field could be challenge enough, experts said.

“I don’t want to predict that they are not going to be able to make the necessary player moves,” Zimbalist said. “I’m just saying it’s a question mark.”

--

david.wharton@latimes.com

Shaikin reported from New York; Wharton from Los Angeles. Times staff writer Diane Pucin contributed to this report.

More to Read

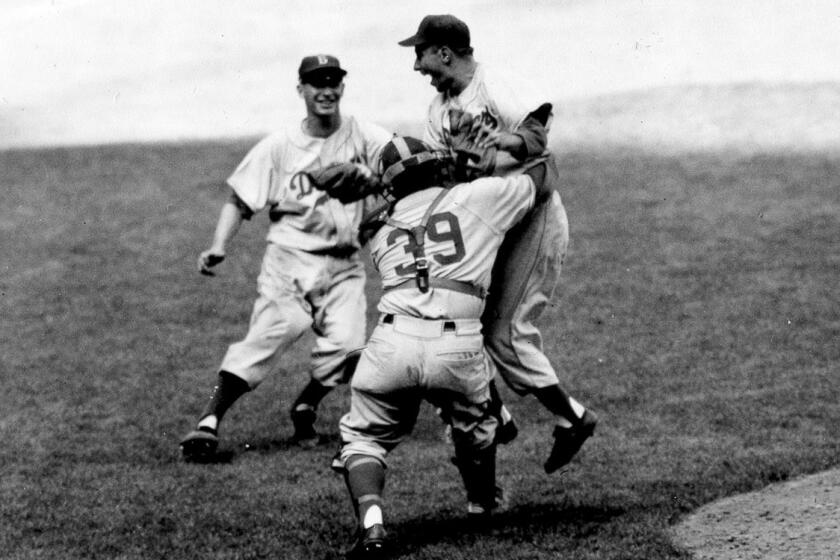

Are you a true-blue fan?

Get our Dodgers Dugout newsletter for insights, news and much more.

You may occasionally receive promotional content from the Los Angeles Times.