In search of a way to defuse the debt limit brinkmanship

Reporting from Washington — As another showdown approaches over raising the nation’s debt limit, people across the political spectrum are looking for ways to defuse an unusual budgetary mechanism that in recent years has ignited frequent congressional brinkmanship and threatened the shaky U.S. economy.

“I would say, please take the gun out of their hands,” said Steve Bell, a former Republican Senate staffer who now directs economic policy for the Bipartisan Policy Center think tank.

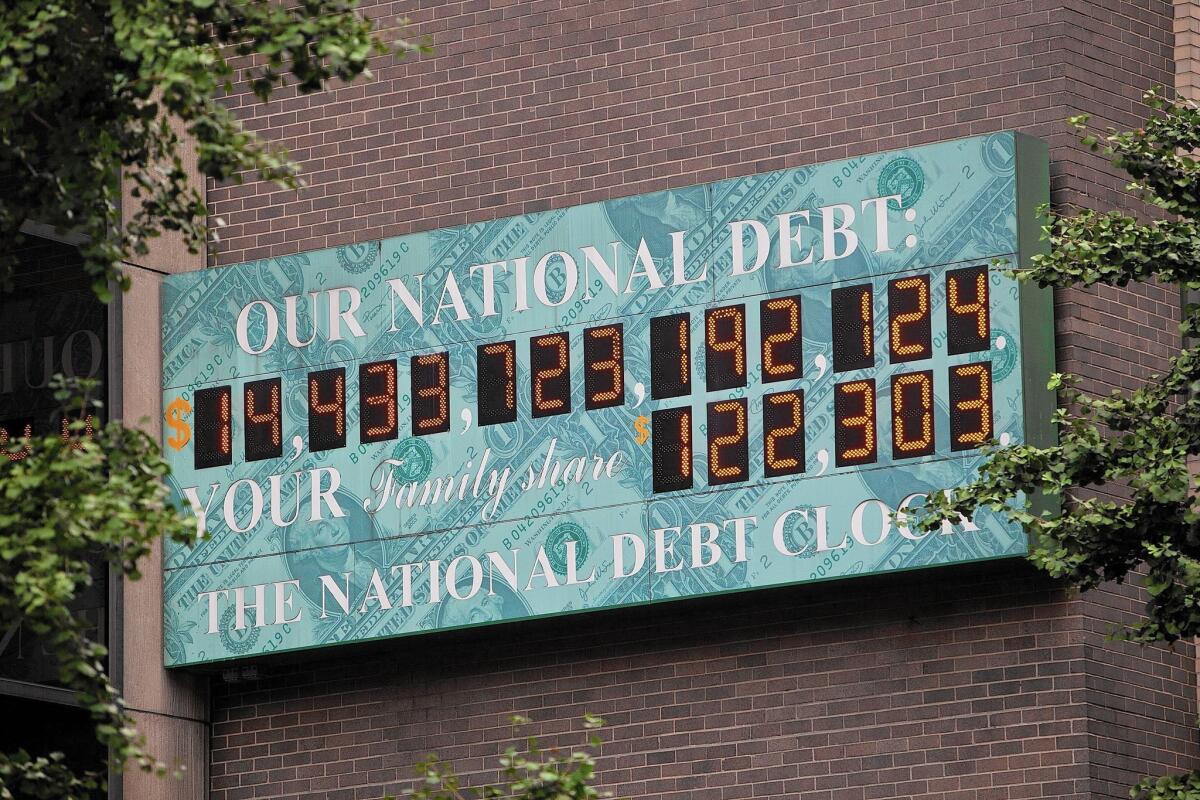

Last week, Treasury Secretary Jacob J. Lew warned Congress that it needed to increase the $18.1-trillion debt limit by Nov. 3 or risk a federal government default.

------------

FOR THE RECORD: In the Oct. 19 Business section, an article about the federal government’s debt limit said that Standard & Poor’s downgrade of the nation’s credit rating in 2011 caused the Treasury Department to pay $1.3 billion more in borrowing costs that year, according to a Government Accountability Office report. The report said it was the delay in raising the debt limit that led to the increased borrowing costs.

------------

After that point, the Treasury would no longer be able to borrow to pay bills and would have only $30 billion in cash to pay daily bills, which can total as much as $60 billion.

“Operating the United States government with no borrowing authority, and with only the cash on hand on a given day, would be profoundly irresponsible,” Lew wrote to House and Senate leaders.

In a time of large budget deficits and deep partisan divides, the recurrent need for Congress to increase the statutory ceiling on government debt has become another crisis point to be used for political advantage.

The debt limit has more than doubled since 2007, and total U.S. debt is equal to the nation’s entire annual economic output.

Since taking control of the House in 2011, Republicans have tried to tie increases in the debt limit to future government spending cuts even though the borrowing is for expenditures that Congress already has authorized.

But unlike many other Washington disputes, the debt limit can have quick and costly real-world implications.

A 2011 standoff, resolved at the last minute before a potential default, led Standard & Poor’s to issue the first-ever downgrade to the nation’s AAA credit rating. The move caused the Treasury Department to pay an additional $1.3 billion in borrowing costs for that year alone, according to the Government Accountability Office.

Two years later, the agency said another debt limit clash increased the Treasury’s borrowing costs by $38 million to $70 million as investors avoided buying bonds the government might not be able to repay.

For those reasons, the GAO recommended this summer that Congress consider alternatives to the debt limit.

Around the same time, two respected Washington veterans at the Bipartisan Policy Center — former Sen. Pete Domenici of New Mexico, a Republican, and former Federal Reserve Vice Chairwoman Alice Rivlin, a Democrat — proposed automatically increasing the debt limit when Congress passes a budget.

Some congressional Democrats, including Sen. Barbara Boxer of California, have called for the law to be changed so the debt limit would increase unless Congress voted to block it.

Even some Republicans have called for changes.

A bill sponsored by Rep. Tom McClintock (R-Elk Grove) would allow the Treasury Department to exceed the debt limit to pay principal and interest on government bonds as well as to send out Social Security checks.

NEWSLETTER: Get the day’s top headlines from Times Editor Davan Maharaj >>

“It’s an absolute guarantee that the debt of the United States will be honored even if there is complete political gridlock in Washington,” he said of the Default Prevention Act, which could get a vote in the House this week.

At one time, Congress controlled federal debt by authorized borrowing for specific purposes, such as building the Panama Canal. The funding needs of World War I led to more flexibility for the Treasury to borrow and limits on specific types of debt.

In 1939, Congress gave the Treasury even more leeway by eliminating the specific limits and setting on an overall ceiling of $45 billion on total federal debt.

For decades, the debt limit sat harmlessly in U.S. law like a human appendix, increased with little controversy whenever needed, said Neil H. Buchanan, author of the 2013 book “The Debt Ceiling Disasters: How the Republicans Created an Unnecessary Constitutional Crisis and How the Democrats Can Fight Back.”

“If it were gone, it would be fine. But it was no problem to have it,” said Buchanan, an economist and law professor at George Washington University.

The debt limit rose to $300 billion at the end of World War II and has been adjusted 95 times since 1940, nearly all of them increases.

In the 1980s, it began to be used as political leverage for spending and deficit reduction deals as congressional Democrats clashed with President Reagan. When Republicans wielded it against President Clinton in the mid-1990s, the Treasury developed so-called extraordinary measures to stave off default by temporarily creating more borrowing authority through the juggling of some government investments.

Most other countries don’t have a debt limit. An increase in borrowing is incorporated in their spending bills. Australia enacted a debt limit in 2009, but raising it became so contentious that the limit was eliminated four years later.

Some people would like to see the U.S. do the same thing.

“To me, the debt limit has become a politically pernicious event,” Bell said. “In a time of interconnected and fragile markets, it is a dangerous thing.”

A U.S. government default would reverberate throughout global markets because the value of 90-day Treasury securities are the benchmark for a slew of complex financial products, such as derivatives and credit default swaps.

A 2013 survey of academic economists by the University of Chicago found that 84% agreed that “a separate debt ceiling that has to be increased periodically creates unneeded uncertainty and can potentially lead to worse fiscal outcomes.” Only 3% disagreed.

“It’s being used as a political nuclear weapon,” said Rep. Peter Welch (D-Vt.), who advocates eliminating the debt limit.

“In the past the out-of-power party would do some grandstanding to make a point, but at the end of the day, there would be a bipartisan vote to avert default,” he said. “That changed in 2011 when some members of Congress were willing to send us into default.”

McClintock said Republicans don’t want a default, but the debt limit is “the equivalent of a national credit card limit” that Congress needs to review.

“The times being what they are, there will be great controversy attached to the review of policies that are driving our debt,” McClintock said.

He figures that by ensuring the U.S. doesn’t default on payments to those holding Treasury securities, as his bill would do, “we would give Congress the calm it needs to negotiate the changes that have to be made to bring our debt under control.”

But others said that the failure of the U.S. to pay all of its outstanding bills would constitute a default, which would risk financial market turmoil and another possible credit rating downgrade.

In a detailed analysis, the Bipartisan Policy Center estimated that the Treasury would run out of money to pay all of its bills between Nov. 10 and 19.

“That could be a dicey, uncharted situation,” said Shai Akabas, the center’s associate director of economic policy.

ALSO

Gov. Brown’s link between climate change and wildfires is unsupported, fire experts say

This is what it’s like to run for local office -- from 2,296 miles away

Ted Cruz is wooing voters who favored rival Rand Paul’s father, and it may be working

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.