Pay expert praises structure of Wells Fargo CEO’s compensation

The $22.9-million pay package that Wells Fargo & Co. awarded Chief Executive John G. Stumpf last year is designed so that more than half of it depends on the bank’s performance over three years -- a stride in the right direction, says an often-critical compensation analyst.

The compensation, the highest for any CEO at a major U.S. commercial bank, was disclosed Thursday in Wells Fargo’s proxy statement to shareholders.

It includes a $12.5-million component: the value of 398,470 Wells Fargo shares in February 2012, when they were granted to Stumpf.

The catch is that he won’t own the stock outright until the end of December 2014. Depending on how the bank does compared with its rivals, the number of shares he receives could then be adjusted up as much as 50% or down to as few as zero.

The arrangement received a provisional endorsement from corporate governance expert Paul Hodgson, who told The Times on Thursday that U.S. banks lag behind European banks when it comes to basing pay on long-term performance.

Hodgson, a former Corporate Library analyst who is now an independent expert on executive pay, liked two aspects of Stumpf’s pay deal:

-- The entire long-term incentive award is based on performance.

-- The award depends on him outperforming his peers.

“Of course,” Hodgson said, “he will still get some shares even if he underperforms half of them, if you read the fine print. In fact, he has to underperform 75% of them to get nothing, which is hardly the toughest requirement in the world.”

Which leaves the compensation on the right track, but with the performance awards still too easy to attain, Hodgson said. “Such a condition would not pass muster in Europe.”

Stumpf, who became Wells’ CEO in June 2007, got a thumbs-up at last year’s annual meeting from shareholders, who by a 96% vote approved his 2011 pay of $19.8 million.

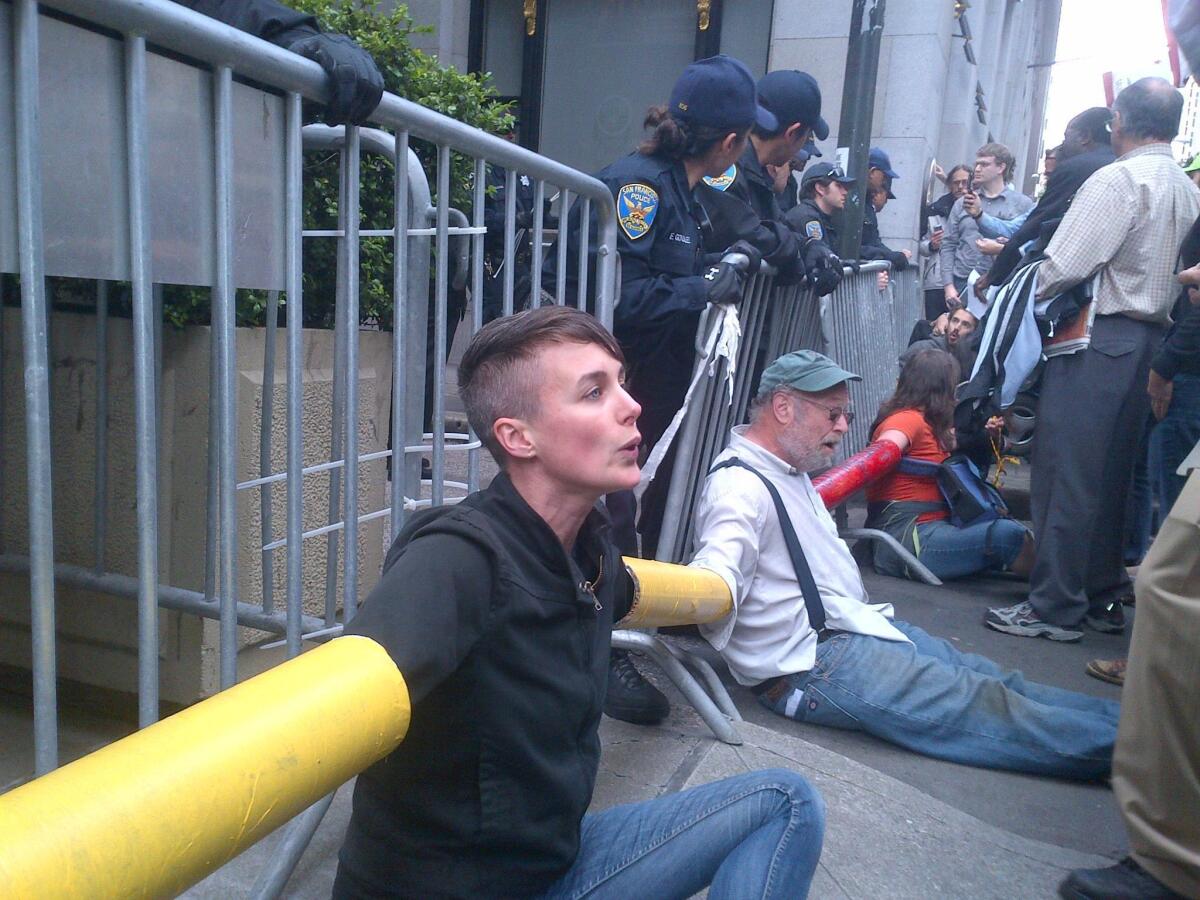

The meeting, held near the bank’s headquarters in downtown San Francisco, was disrupted by more than 1,000 protesters who shut down nearby streets. A handful infiltrated the session itself and challenged Stumpf to show more compassion for struggling mortgage borrowers.

The proxy said this year’s annual meeting, on April 23, will be held far away -- in Salt Lake City.

WFC Net Income Quarterly data by YCharts

ALSO:

Wells Fargo CEO is highest-paid banker, at $22.9 million

Stumpf in 2012: Shareholders OK pay as protests rage outside

Stumpf in 2011: New regulations will mean new fees for customers

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.