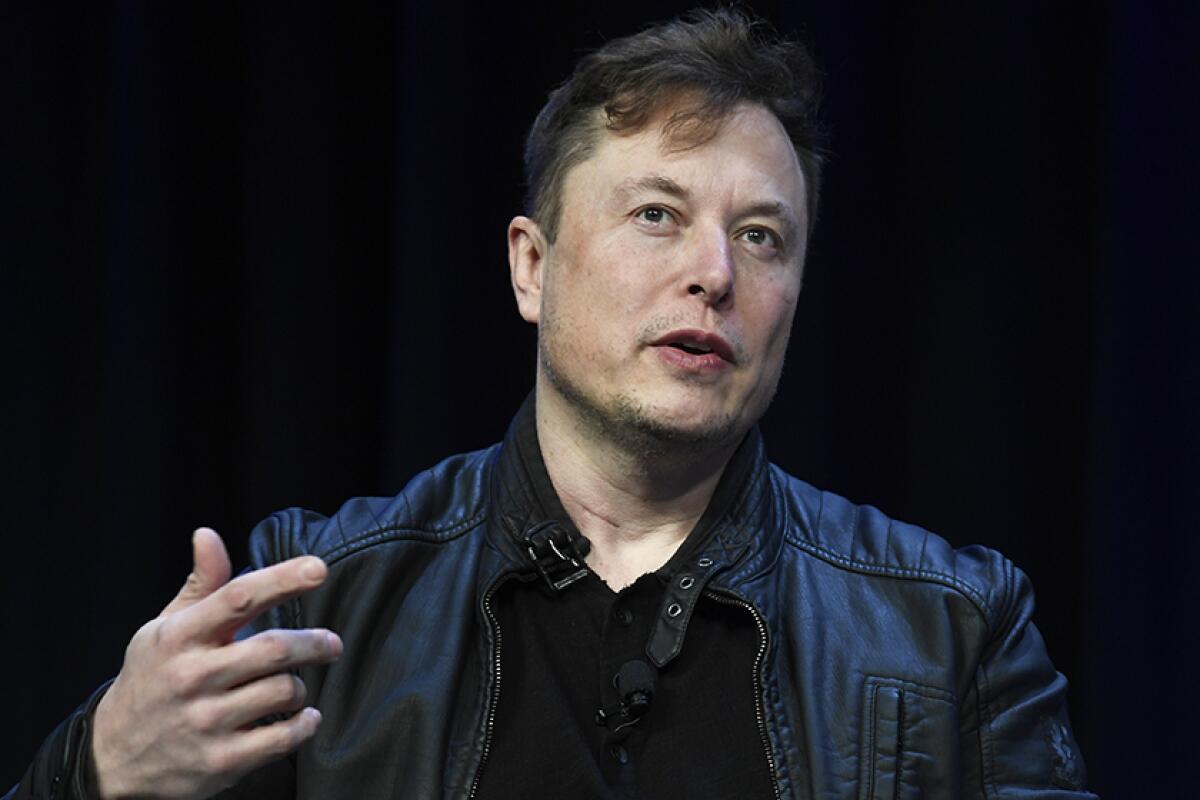

Elon Musk’s bid to buy Twitter was extremely Elon Musk

It was a classic Elon Musk move: announce a new offering that would radically transform the technology landscape, flog it onstage and in social media posts, only for it to turn out that the offering in question was nowhere close to market-ready.

Only this time, it wasn’t a self-driving taxi or domestic robot or electric truck the world’s richest man was touting. It was a plan to buy Twitter, Musk’s favorite megaphone and time-waster and, according to him, a public square of vital importance to democracy.

Early Thursday, the Tesla and SpaceX chief executive notified the Securities and Exchange Commission of a bid to buy all of Twitter for $54.20 a share, or $43 billion. “Twitter needs to be transformed as a private company,” he wrote in a letter to Bret Taylor, chair of its board of directors.

Within hours, the social media service’s board was reportedly mulling over strategies for holding him off, Wall Street was behaving as if the bid was another one of Musk’s jokes, and Musk himself was acknowledging that it might not happen — even while leaning on the board to take his offer straight to a shareholders’ vote.

Musk opened negotiations by saying his offer was nonnegotiable; it would pay shareholders a tidy 18% premium over the current price. But given that Twitter has traded at a 52-week high of $73, it was far from the kind of offer the company’s board would be hard-pressed to refuse, analysts say.

“I don’t believe this board comes back ... with a yes,” said Brent Thill, a tech analyst at the financial services and investment banking company Jefferies. “We think the offer would have to be at $60 or above” to avoid rejection out of hand, he said.

Thill speculated that Musk’s inclusion of the marijuana-associated number 420 in the per-share offer price may have sent the wrong signal, suggesting he’s playing to a crowd of fellow meme-humor enthusiasts.

Although it has a fiduciary duty to consider any bid, Twitter’s board can’t afford to take his offer more seriously than he himself takes it, said Tero Kuittinen, a senior analyst at the wealth management company Afalon Investment Management.

“What is the risk that Musk will handle this process in a manner that may hurt the share price? What is the risk that the transaction never closes?” he said in a Twitter direct message. “I’m deeply skeptical the board would accept considering the share price was recently much higher and the risk associated with capricious public comments of Mr. Musk is high.”

Traders seemed to agree. After a quick pop in price, Twitter shares closed down 1.7% to $45.08. Usually when a buyer makes such an offer, the stock price immediately rises to near the offer price if traders think the deal will go through.

After acquiring a 9% stake in Twitter, Elon Musk questioned free speech on the platform and asks whether it is undermining democracy.

In a news release, Twitter said that its board of directors “will carefully review the proposal to determine the course of action that it believes is in the best interest of the company and all Twitter stockholders.” Musk was himself supposed to join the board earlier this month but ultimately declined the offer, which would have obligated him to keep his ownership of the company below 15%.

Musk acknowledged he may have overreached during an onstage interview at the TED conference in Vancouver, Canada, on Thursday morning, saying, “I’m not sure I will actually be able to acquire it.” He said he had a Plan B but declined to discuss it.

The Wall Street Journal reported that Twitter’s board was discussing the possibility of adopting a so-called poison pill provision that would prevent Musk from increasing his current 9.2% stake in the company to more than 15%, making it harder for him to attempt a hostile takeover.

Should the board reject his offer, Thill said, “it’s really up to [Musk] where he wants to take it. I think there’s really only two doors that I see that would happen. Door one is he says, ‘Fine, I don’t want anything to do with this team’ and sells his position that he built, or he reconsiders the ‘final’ offer and says, ‘Well, it’s really not final.’”

Ali Mogharabi, a senior equity analyst at Morningstar, pinned the likelihood of Twitter agreeing to Musk’s terms at less than 50%. Gary Black, a managing partner at the Future Fund, expressed similar doubts. And billionaire celebrity investor Mark Cuban tweeted that Twitter “will do everything possible not to sell.”

Whether Musk has the wherewithal to do the deal is another question. Musk settled fraud charges with federal financial regulators in 2018 after the Securities and Exchange Commission said he used Twitter to announce that he had “funding secured” to take his electric car company private when he did not. Musk was also late filing SEC documents about his stake in Twitter and is now facing a shareholder lawsuit over the lapse, although the SEC hasn’t said anything about it.

He hasn’t spelled out details on how he would finance his purchase of Twitter. Musk’s personal wealth is estimated to be about $265 billion, but most of that is in Tesla stock. In order to tap that wealth, he’d need to take loans with his shares as collateral, which could hurt the share price.

Although Musk has said taking Twitter private would help it serve a “societal imperative,” Jennifer Edwards, executive director of the Texas Social Media Research Institute at Tarleton State University, said that having a single person exerting control over one of the biggest social networks in the world is concerning.

“When one man gains majority ownership of a company like Twitter, the checks and balances system” that incentivizes platforms to promote the spread of accurate information online “might become less effective” than they’d be under a public company’s board of directors, Edwards wrote in an email. (Of course, that is the case at Facebook parent Meta Platforms Inc., where Mark Zuckerberg’s supervoting stock gives him complete control of a much larger platform.)

“Musk has just, time and again, made decisions about what’s good for him,” said Jessica González, co-chief executive of the media advocacy group Free Press. “He’s used Twitter to sway markets to his own benefit. It’s just gross. He’s an unaccountable billionaire, and taking this company private would make it even less accountable.”

Elon Musk and Tesla have millions of vocal fans on Twitter. Not all of them are real. Two researchers are trying to figure out who controls the bots.

At the TED event, Musk said that he wanted to allow users to edit posts and that the company should be a lot more transparent about who it’s banning or putting in a “timeout” and why. “Tweets are being promoted and demoted with no idea what’s going on,” he said.

But pressed by host Chris Anderson on how that would work in detail, Musk said, “I’m not saying I have all the answers here.”

Musk’s interest in Twitter is predominantly ideological rather than a profitable business decision, said Greg Autry, clinical professor of space leadership, policy and business at the Thunderbird School of Global Management at Arizona State University and a space industry leader.

“He’s an outspoken proponent of free speech, and he doesn’t like the censorship model ever present on social media and on Twitter in particular,” he said. “He could do better things with his money if he wanted to just make money.”

The Associated Press was used in compiling this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.