Column: Wall Street Journal tells us to weep for the plight of the very, very rich

Coverage of the richest Americans in publications aimed at their tax bracket tend to fall into two genres.

One is stories claiming that income well into six figures doesn’t make them really “rich.” The other involves hand-wringing and whining about their (purportedly) ruinous tax bills.

An editorial last week in the (of course) Wall Street Journal may stand permanently, or at least until the end of recorded time, as the Platonic ideal of the latter genre.

Whatever is the existing degree of progression, people who pay the top rate will think it is too much.

— Economist Herbert Stein (1996)

Headlined “How America Soaks the Affluent,” it strives to persuade us that the federal income tax is already an insurmountable burden for the rich.

Therefore, it says, President Biden’s intention to raise taxes on those beleaguered Americans is just so very deeply unfair.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Color me just a teeny bit unpersuaded.

The Journal erects its case on these fundamental assertions: According to 2020 figures from the Internal Revenue Service (the most recent year available), the top 1% of earners paid 42.3% of the country’s income taxes while accounting for only 22.2% of all Americans’ adjusted gross income.

Admission to the 1% required annual earnings of at least $550,000; they paid “an average income-tax rate of 26%.” The average fell as one moved down the income ladder, until reaching the bottom 50% of taxpayers (earnings less than $42,000), who paid an average rate of 3.1%.

The article uses these statistics to argue that Biden, in asserting that the rich don’t pay their “fair share,” is engaged in cherry-picking “demagoguery.”

So let’s take a closer look to determine whose cherries are really being picked.

To begin with, the Journal says its findings are based on “a Tax Foundation analysis of the IRS data for 2020.” That makes it sound like an objective analysis by an independent organization. It might help to know a little bit more about the Tax Foundation, however. It was founded in 1937 by Alfred P. Sloan, chairman of General Motors, along with the chairmen of Standard Oil and Johns Manville.

Despite pandemic closures and more shareholder votes against their pay, CEO compensation keeps soaring. But there are signs the backlash is working.

(Sloan, in disembarking from an ocean liner bringing him home from three weeks’ vacation in the south of France in 1934, condemned pressure from New Deal Democrats for GM to provide its workers with shorter hours and higher pay. “Of course I believe in more leisure for workers,” he said. “But not by government edict. We should earn our leisure.”)

Among the Foundation’s donors since then has been the Koch network.

Much of the Journal’s analysis is based on sleight-of-hand. Notice, for instance, its persistent focus on the federal income tax. That system is, as the Journal says, “progressive,” meaning that the rates rise with income. (The Journal says “steeply progressive”; more on that in a moment.)

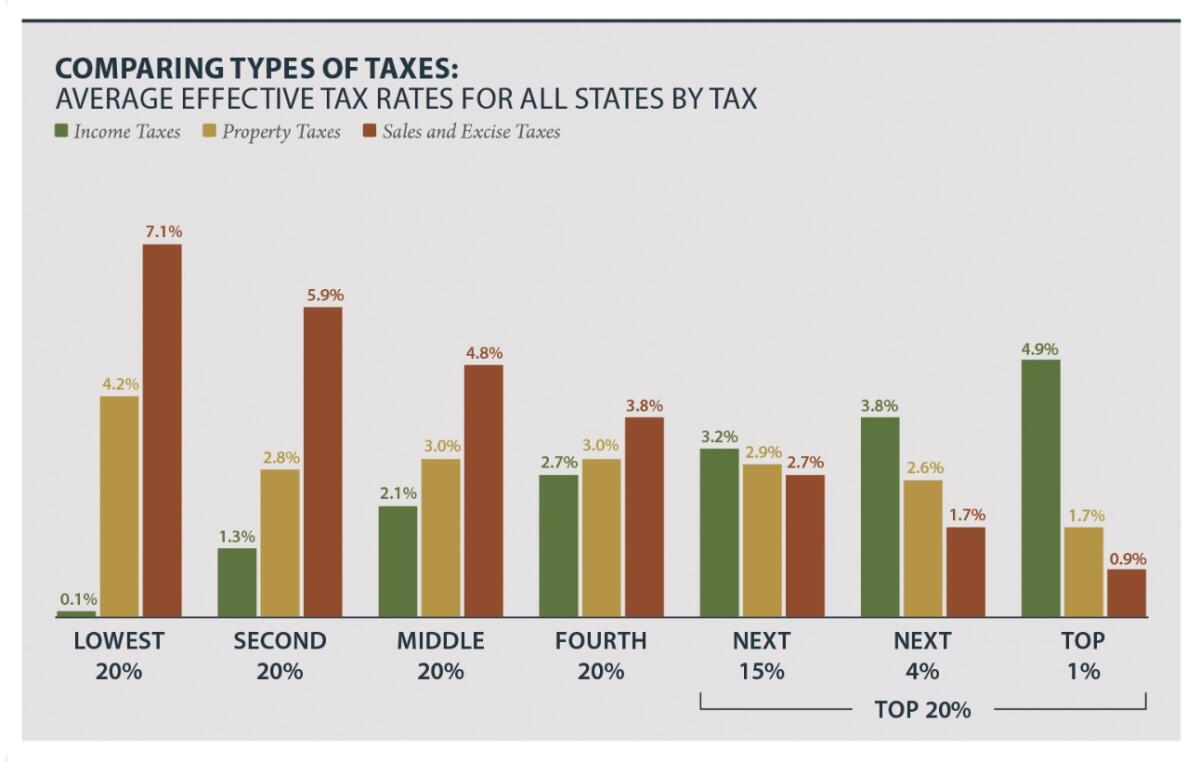

That leaves out levies such as the payroll tax, which funds Social Security and Medicare, and sales taxes; the Journal allows that these are “less progressive.” In fact, they’re immensely regressive, meaning they hit middle- and lower-income Americans much harder than the rich.

The Social Security payroll tax, for instance, comes to 12.4% of all wage income up to a cap this year of $160,200. Anyone earning up to that much in salary will pay that rate, topping out at $19,865 this year. (The levy is shared equally by employees and employers, but in economic terms, the employees pay both ends.)

For someone with wages of, say, $320,000, that bill amounts to a rate of only 6.2%. For someone with wages of $1 million, it comes to only about 2%. One more wrinkle: Millionaires generally get about half their annual income in capital gains and dividends, which aren’t subject to the payroll tax. Factor that in, and their effective payroll tax rate is about 1%.

The Journal doesn’t mention that. On Tuesday, as it happens, Biden announced a proposal to raise the net investment tax — that is, a tax on capital gains and dividends — from 3.8% to 5% for taxpayers with annual income of more than $400,000.

State and local sales taxes help to make America’s overall tax system regressive. Averaging all sales and excise taxes nationwide, the lowest-income 20% of Americans (with earnings in 2018 of less than $20,800 pay 7.1% of their income in those taxes; the top 1% pay an average rate of 0.9%, according to the Institute of Taxation and Economic Policy (a think tank without any links to the Kochs).

Indeed, the states that brag the loudest about having no income tax, such as Texas and Florida, are among those that soak middle- and lower-income residents the most.

Republicans say Biden is lying about their intention to cut Social Security and Medicare. The evidence backs him up.

ITEP calculated that in Texas, the poorest fifth of all households paid 13% of their family income in state and local taxes, compared to 3.1% of income paid by the top 1%. In Florida, the poorest fifth paid 12.7% of their income; the 1% forked over 2.3%.

If you’re confused about why corporate executives love to locate their headquarters in those two states (I’m looking at you, Elon Musk), those statistics should clear things up. The salient features of both states’ tax systems are the absence of an income tax and heavy reliance on sales, excise and property taxes.

The key trick performed by the magicians in the Journal’s opinion department is making the elephant in the room disappear. That’s the elephantine share of all national income collected by the 1%. It has risen from 9% in 1979 to more than 22% now. That’s pre-tax income. After-tax income for that segment has risen from 7.4% in 1979 to more than 14% today. Meanwhile, the share of the bottom 60% of households has fallen from about 33% to about 27%.

The federal income tax system is still progressive, but has been getting less so. In 1950 the top 1% paid an average 32.6% of their pre-tax income in total taxes; by 2018 the figure had dropped to 27.5%. The Journal wants you to think that’s a trivial change. Sez who? For a household with $500,000 in income, that’s a reduction in tax paid of about $25,500, or more than the average earnings of families in the lowest 20% of American households.

What those figures mean is that the tax system hasn’t done much to put a collar on the unequal distribution of income and wealth in this country. As economist Gabriel Zucman of UC Berkeley told the Senate Budget Committee in 2021, the high marginal rates on income in the 1940s and 1950s, which exceeded 90% (on incomes over $200,000, or about $2.5 million today), were designed to reduce inequality.

The neoliberalism of Ronald Reagan has served only the rich, yet it still governs American economic policy. UC Berkeley’s Brad DeLong examines why in his new book.

“This policy achieved its goal,” he testified. “The share of America’s pre-tax national income earned by the top 0.01% declined from more than 4% on the eve of the Great Depression to 1.3% in 1975, its lowest level ever recorded.” A similar trend applied throughout the top-earning segment.

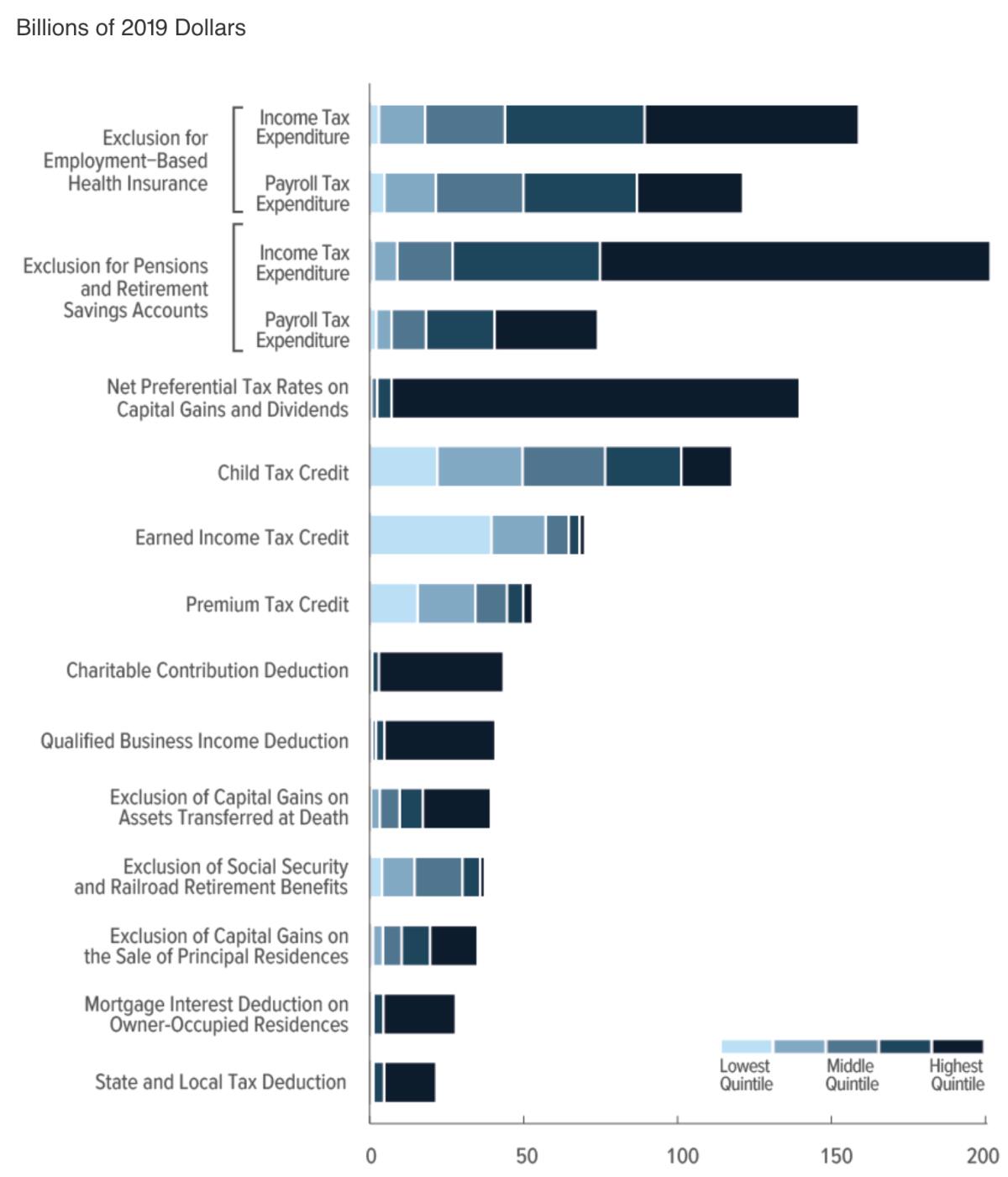

The mechanisms of inequality are no secret. They include sharp reductions in marginal tax rates and skewed distribution of major tax breaks toward the rich, including preferential rates on capital gains, tax benefits for retirement plans such as 401(k) plans, and deductions for charitable contributions.

About half the benefits of those major tax breaks were enjoyed by households in the top 20%, according to the Congressional Budget Office. Only about 9% of the benefits went to households in the bottom 20%.

“The basic truth is that the rich really do pay their fair share,” the Journal editorialists write. This is a perfect example of an observation by the leftist writer Upton Sinclair: “It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

There is one virtue in the Journal’s sob story. It gives me an opportunity to reprint my all-time favorite line about the U.S. tax system, which appeared in a 1996 op-ed — in the Wall Street Journal! — by Herbert Stein, who as Richard Nixon’s chief economist was a man unlikely to be mistaken for a flaming liberal.

In a discussion of whether the U.S. tax system was too progressive, not progressive enough, or just right, Stein wrote that in his 60-year professional career he had concluded that “whatever is the existing degree of progression, people who pay the top rate will think it is too much.”

The Wall Street Journal is still pulling out all the stops to prove him right.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.