The scramble to fix California’s home insurance mess failed. Here’s what will happen next

New home buyers — and people getting dropped from their existing coverage — have had a tough time finding homeowners insurance this summer in California as more and more major insurers stop writing new policies in the state.

State lawmakers spent recent weeks trying to piece together a deal that would make it easier for companies to charge higher prices, in the hopes of enticing carriers to reopen for new business. As the clock struck midnight on Monday night, marking the final deadline for introducing a new bill to be voted on before Thursday’s close of the legislative session, a deal had failed to materialize.

But major changes to the state’s current regulatory regime could still come this year, whether by action from Gov. Gavin Newsom or, more directly, from Insurance Commissioner Ricardo Lara, who oversees the state’s insurance regulatory system. The state Assembly will also hold more hearings on the topic this fall, which could set the stage for legislative change next year.

“We just couldn’t find that sweet spot in protecting our consumers and creating a stable insurance market,” said Sen. Bill Dodd (D-Napa), who represents a wine region that has seen devastating wildfires in recent years.

Even as insurers flee California, lawmakers couldn’t hammer out a deal to fix the collapsing market. Inaction will only make disasters more expensive.

The proposal would have involved concessions to insurers on the sticking-point issues of reinsurance costs and catastrophic modeling, while also generally requiring insurance companies to stay in the market, with some caveats, Dodd said.

California Senate leader Toni Atkins (D-San Diego) said one difficulty in reaching agreement on how to fix the insurance market was elected officials’ concerns about the political consequences of raising rates for consumers.

“It is serious when you are talking about raising rates,” she said. “Whatever direction we go in, in order to cover this crisis that we have — not just in California — rates are probably going to have to go up. And nobody wants to hear that. That’s a mathematical dilemma.”

On Wednesday morning, Lara said that legislation was just “one of many options,” and that a “package of regulatory solutions” to streamline the regulatory process is in the works at the Department of Insurance. “We will continue moving forward,” his statement concluded.

California’s biggest seller of homeowners insurance says regulations and wildfires make new policies a financial loser. But there are reasons to question that explanation.

Since the beginning of the year, companies representing more than half of California’s $12-billion home insurance market have stopped or limited new policies. State Farm, Allstate and USAA have effectively closed for new business, Farmers has put a cap on the number of new policies it will write each month, and Travelers and Nationwide have put new restrictions in place that make it more difficult for new customers to qualify for policies.

The companies say that state regulators won’t allow them to raise rates high enough to keep pace with ballooning costs and risks, and many have filed requests for double-digit increases in the average rates they charge homeowners.

In February, State Farm filed for a 28.1% increase, and in April, Allstate and USAA asked for 39.6% and 30.6% hikes, respectively. None have been approved. Earlier this year, Farmers, the second-largest home insurer in the state, requested a 25.5% bump to a subset of its policies covering 1.2 million homeowners, and was approved for a 12.5% increase in August after the rate review process, with consumer advocates intervening to argue down the number.

These top line numbers represent how much a company is allowed to raise its total revenue in the state, but the rate increase can be distributed differently among homeowners: a house in the Sierra might see a much bigger hike, while a house in the middle of Los Angeles could see none at all.

On the cost side, inflation has been driving up the prices of building materials and construction labor for the last 18 months, and the cost of reinsurance, which insurers themselves have to pay to hedge their own risks, surged in late 2022. In just the first three months of 2023, State Farm General Insurance, the subsidiary of the national company that only writes home insurance in California, lost more money on claims than it did in all of 2022, largely due to these rising costs.

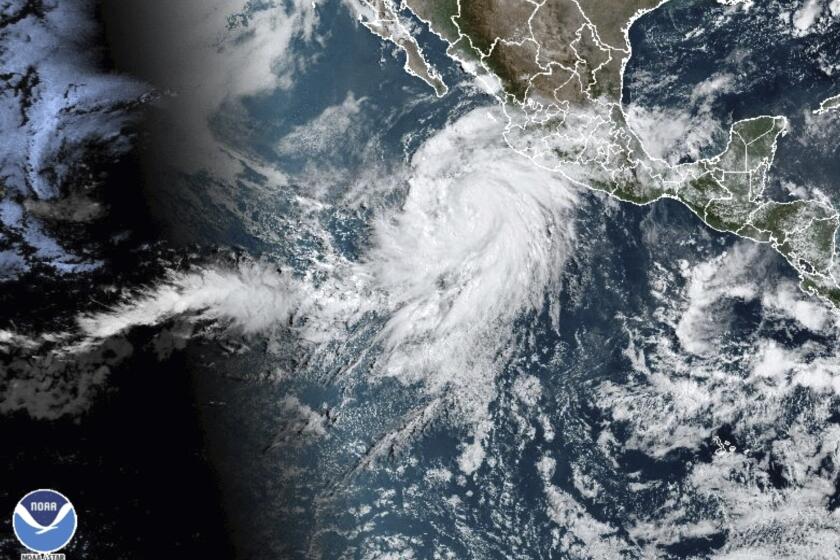

The risk of losses to catastrophic events has been rising as well, from unexpected summer hurricanes to disastrous wildfires, as rising global temperatures push California’s climate into unfamiliar terrain.

The rumblings of a legislative response to the state’s deteriorating market for new home insurance began in August, when state Sen. Susan Rubio (D-Baldwin Park), chair of the Senate Insurance Committee, told Politico that “we are in a crisis and something needs to be done.” A few days later, the Republican caucus in the state Senate released a public letter calling on the insurance commissioner to change the existing regulatory system.

For at least the last 165 years, three conditions have kept California hurricane-free, experts say. So what’s changed to make Hurricane Hilary possible?

Last week, a coalition of powerful business groups — including the California Assn. of Realtors, the California Building Industry Assn. and the California Apartment Assn. — circulated a letter calling on their members to reach out to lawmakers to support the legislation that was in the works. But as the dust settled this week, it became clear that there would be no deal.

All along, consumer advocacy groups decried what they saw as an opaque process to deregulate the insurance industry, dubbing the secret deal a “bailout” for insurers. At one point in late August, the president of Consumer Watchdog caught a lobbyist on tape on a flight from Los Angeles to Sacramento saying that the goal was to “jam a bill in the last three weeks of the year.”

In a statement after the deal was confirmed dead, Harvey Rosenfield, founder of Consumer Watchdog and author of Proposition 103, the 1988 ballot measure that created the current regulatory regime for insurance, celebrated its demise.

“California lawmakers wisely chose not to burn their constituents by passing a half-baked bailout that would make insurance even more unaffordable and unavailable, and do nothing to guarantee that any Californian who needs to buy a policy could do so,” Rosenfield said.

Under the system created by Proposition 103, insurance companies have to submit detailed requests to the elected insurance commissioner before they’re allowed to raise their overall rates across the state. The letter of the law says that the process should take at most six months, if all goes smoothly, but in practice it often takes much longer. If a company requests an increase of 7% or more in its rates, groups such as Consumer Watchdog are allowed to intervene more actively, and potentially take the company to an administrative trial to determine the acceptable rate increase, which adds more time to the process. As a result, most insurers filed a steady stream of 6.9% bumps for years.

GT’s Living Foods’ kombucha factory subjected workers to ‘deplorable and abusive and disturbing working conditions,’ according to a court ruling.

But the backlog of rate filings has grown in the last year, which has left insurers charging pre-inflation prices while paying out post-inflation losses.

Rex Frazier, president of the Personal Insurance Federation of California, an industry group, said that the process as a whole needs to speed up.

“What other business is forced to wait six months to a year to change their prices?” Frazier said. Despite the backlog, he said, the Department of Insurance has not significantly sped up its operations, and “if anything, the backlog has slowed them down.”

Insurers have been able to adjust for inflation to some degree by increasing customers’ coverage to match the new cost of repairing or replacing their homes, but that has led to a rapid rise in the total amount of liabilities — all those higher-dollar potential losses — on their books, increasing their total risk exposure without significantly increasing the amount of backup capital they have on hand.

Typically, insurers turn to the reinsurance industry to move excess risk off their books, but shifts in the global, unregulated reinsurance market have led to reinsurers charging much higher rates for their services, especially in areas with higher risk of catastrophic loss.

“The spike in the reinsurance market places companies in a position where they cannot afford additional capacity,” Frazier said, which leads insurers to stop writing new policies or even decline to renew some policies in order to shrink their business.

To address these issues, industry advocates have also pushed for changes to regulations enacted by the first insurance commissioner, current U.S. Rep. John Garamendi (D-Walnut Grove). One rule prevents insurance companies from including reinsurance fees in the rate request process, stopping them from passing those costs along to policyholders. Another requires insurers to use past loss data to prove that risks from hazards such as wildfire are increasing in a given area, rather than forward-looking fire models that take into account predictive simulations of climate change or brush coverage, which reinsurers often use when setting their own rates.

Consumer Watchdog argues that allowing insurers to pass along reinsurance rates, though allowed in other states, exposes Californians to an unregulated market and potential self-dealing, since many of the insurance companies and reinsurance companies are part of linked corporate entities. On the question of forward-looking models, the group also argues that it would allow companies to use opaque, unverifiable algorithms to set prices, rather than verifiable historical data.

The insurance commissioner has the power to propose a revision to these regulations at any time, which could change the calculus for some of the large insurers that have pulled back from the California market.

But even if the changes began tomorrow, and insurers leaped at the chance to request the double-digit rate increases that they say they need, it will still take months for the higher prices to be approved, and even longer for them to reach consumers — and insurers’ balance sheets.

“If we’re talking about the full book for an insurer,” Frazier said, “it’s not going to be fully at that new rate” under this hypothetical warp-speed scenario “until some time in 2025.”

For Californians who can’t buy insurance now, or find an affordable policy, that’s a long wait.

Times staff writer Laurel Rosenhall contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.