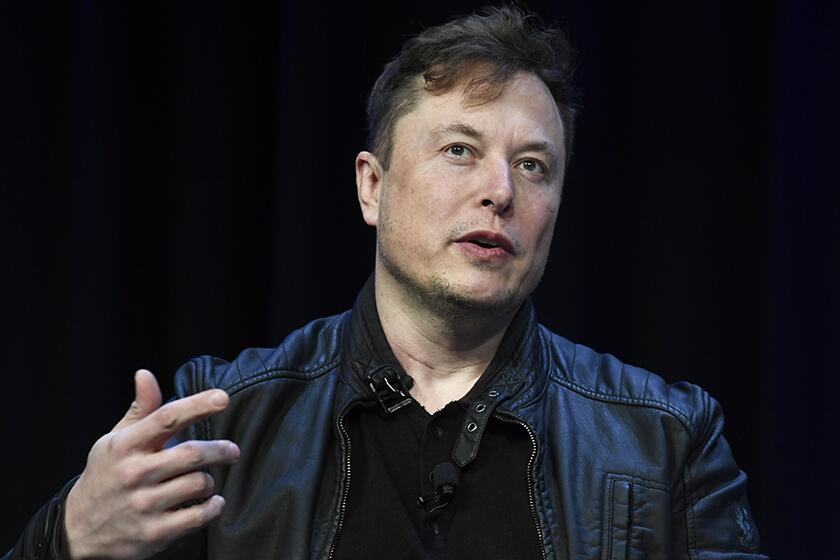

Twitter adopts ‘poison pill’ to ward off Elon Musk takeover

Twitter’s board, responding to Elon Musk’s offer to take the company private, adopts a measure that would shield it from hostile acquisition bids.

Twitter Inc. adopted a measure that would shield it from hostile acquisition bids, taking steps to thwart billionaire Elon Musk’s unwelcome offer to take the company private and attempt to make it a bastion of free speech.

The board set up a shareholder rights plan, exercisable if a party acquires 15% of the stock without prior approval, lasting for one year only. The plan seeks to ensure that anyone taking control of Twitter through open market accumulation pays all shareholders an appropriate control premium, according to a statement Friday.

Twitter enacted the plan to buy time, according to a person familiar with the matter. The board wants to be able to analyze and negotiate any deal, and may still accept it.

The Tesla Inc. chief executive on Thursday offered $54.20 a share in cash for Twitter, valuing the social media company at $43 billion. Musk, who said it was his “best and final” offer, had already accrued a stake of more than 9% in Twitter since earlier this year. Twitter’s board met Thursday to review Musk’s proposal to determine whether it was in the best interest of the company and all of its shareholders.

The billionaire leader of Tesla and SpaceX says Twitter must go private to fulfill its “societal imperative.” But the way he went about offering to buy it left Wall Street doubting his seriousness.

In addition to Musk’s offer, Twitter has been fielding takeover interest from other parties, including technology-focused private equity firm Thoma Bravo, Bloomberg reported earlier Friday. Goldman Sachs Group Inc. and JPMorgan Chase & Co. are advising Twitter.

A so-called poison pill defense strategy allows existing shareholders the right to purchase additional shares at a discount, effectively diluting the ownership interest of the hostile party. Poison pills are common among companies under fire from activist investors or in hostile takeover situations.

Under Twitter’s plan, each right will entitle its holder to purchase, at the then-current exercise price, additional shares of common stock having a then-current market value of twice the exercise price of the right.

After acquiring a 9% stake in Twitter, Elon Musk questioned free speech on the platform and asks whether it is undermining democracy.

Included in Musk’s securities filing disclosing the bid Thursday morning was a script of text he sent to the company. In it he said, “it’s a high price and your shareholders will love it.”

At least one prominent investor, though, said the offer was too low, and the market reaction appeared to agree. Saudi Arabia’s Prince Alwaleed bin Talal said the deal doesn’t “come close to the intrinsic value” of the popular social media platform.

Speaking later Thursday at a TED conference, Musk said he wasn’t sure he “will actually be able to acquire it.” He added that his intent was to also retain “as many shareholders as is allowed by the law,” rather than keeping sole ownership of the company himself.

Twitter shares dropped 1.7% in New York on Thursday, reflecting the market’s view that the deal is likely to be rejected or to fall through. The Wall Street Journal earlier reported the San Francisco-based company was considering a poison pill defense.

Musk first disclosed his Twitter stake on April 4, making him the largest individual investor. At the TED conference, he indicated that he has a Plan B if Twitter’s board rejects his offer. He declined to elaborate. But in his filing earlier in the day, he said he would rethink his investment if the bid failed.

“If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder,” Musk said.

Twitter, unlike Meta Platforms Inc., Snap Inc. and other tech giants, doesn’t have founders with majority voting control. That makes the company particularly vulnerable to activist investors and takeover interest. While it’s unclear what founder and board member Jack Dorsey thinks of Musk’s deal, he at least shares the opinion that Twitter might be better off private.

“As a public company, twitter has always been ‘for sale.’” Dorsey tweeted. “That’s the real issue.”

Bloomberg staff writer Jillian Ward contributed to this report.