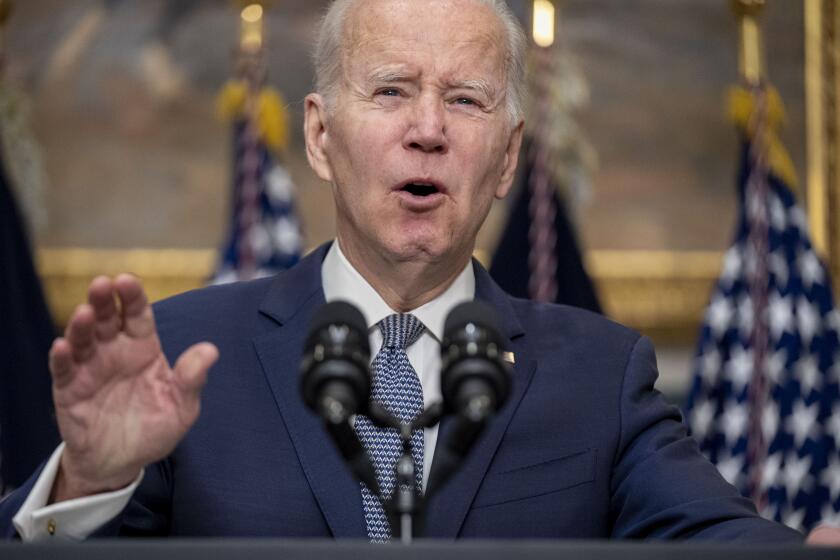

Biden says U.S. banks are in good shape, turmoil will ease

President Biden said he was confident U.S. regional banks were in good shape and didn’t foresee any major crises on the horizon, downplaying Wall Street angst and lingering fears of broader financial turmoil.

“I think we’ve done a pretty damn good job. People’s savings are secure,” Biden said during a news conference Friday in Ottawa alongside Canadian Prime Minister Justin Trudeau. “I think it’s going to take a little while for things to just calm down, but I don’t see anything that’s on the horizon that’s about to explode.”

In response to a question from a reporter about anxiety in financial markets, Biden quipped, “You ever know a Wall Street not in consternation?”

The remarks were Biden’s first on the banking crisis since a week earlier, as he seeks to pivot away from the issue in a bid to project stability and avoid spooking markets.

Biden said that if the banking turmoil persisted, the government is in a position to protect deposits.

Silicon Valley Bank failed late last week, prompting fears of wider upheaval. Here’s what you should know about the collapse and what comes next.

“What we would [do] is, if we find that it’s more instability than appears, we’d be in a position at the FDIC [to] use the power it has to guarantee those loans above $250,000, like they did already,” he said, referring to the Federal Deposit Insurance Corp.

U.S. regulators have come under pressure to offer more clarity about guaranteeing uninsured deposits.

Sen. Elizabeth Warren (D.-Mass.) has called for regulators to raise the guarantees on accounts above the current $250,000 threshold. Treasury Secretary Janet L. Yellen has said regulators aren’t looking to provide “blanket” deposit insurance without working with lawmakers.

Biden last week expressed confidence that the worst of the turmoil roiling the U.S. banking system had passed. And he has publicly punted the issue to Congress, encouraging lawmakers to approve tougher bank regulations and punishments for executives at banks that fail, including strengthening powers to claw back bonuses.

But regulators are still working to stabilize the sector after the collapse of Silicon Valley Bank and Signature Bank, and with worries about the health of another regional lender, First Republic Bank, even though it already received a $30-billion lifeline.

Assuring the public a crisis in the banking system was under control, President Biden blamed his predecessor for creating the conditions for the collapse of Silicon Valley Bank and Signature Bank.

Yellen convened a previously unscheduled meeting of the Financial Stability Oversight Council on Friday, gathering together top U.S. financial regulators.

The banking crunch was exacerbated by troubles at Credit Suisse Group, leading the Swiss government to broker a deal for its takeover by longtime rival UBS Group.

Markets were gripped by fresh volatility Friday with the focus on Deutsche Bank, which saw its shares slump the most in three years.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.